Reaching for your next tax bracket

Dear Intentional Money Life: My company has offered me a pay raise, from $86,000 a year to $87,000 a year. I’m a single tax filer and it looks like this will put me in another tax bracket. Am I going to lose money? How can I avoid paying that higher tax rate?

Dear Earner,

No you are not going to lose money, because that is not how tax brackets work. Relax and enjoy your raise!

Remember Deductions First

The first good news is that you're not actually touching that tax bracket because your taxable income after the standard deduction ($12,550) is only $74,450. That's how much you're taxed on. But if I made this whole blog post about $74,450 it would be very boring, so I'm going to pretend you're faced with an income that crosses brackets even after the standard deduction.

How tax rates get confused

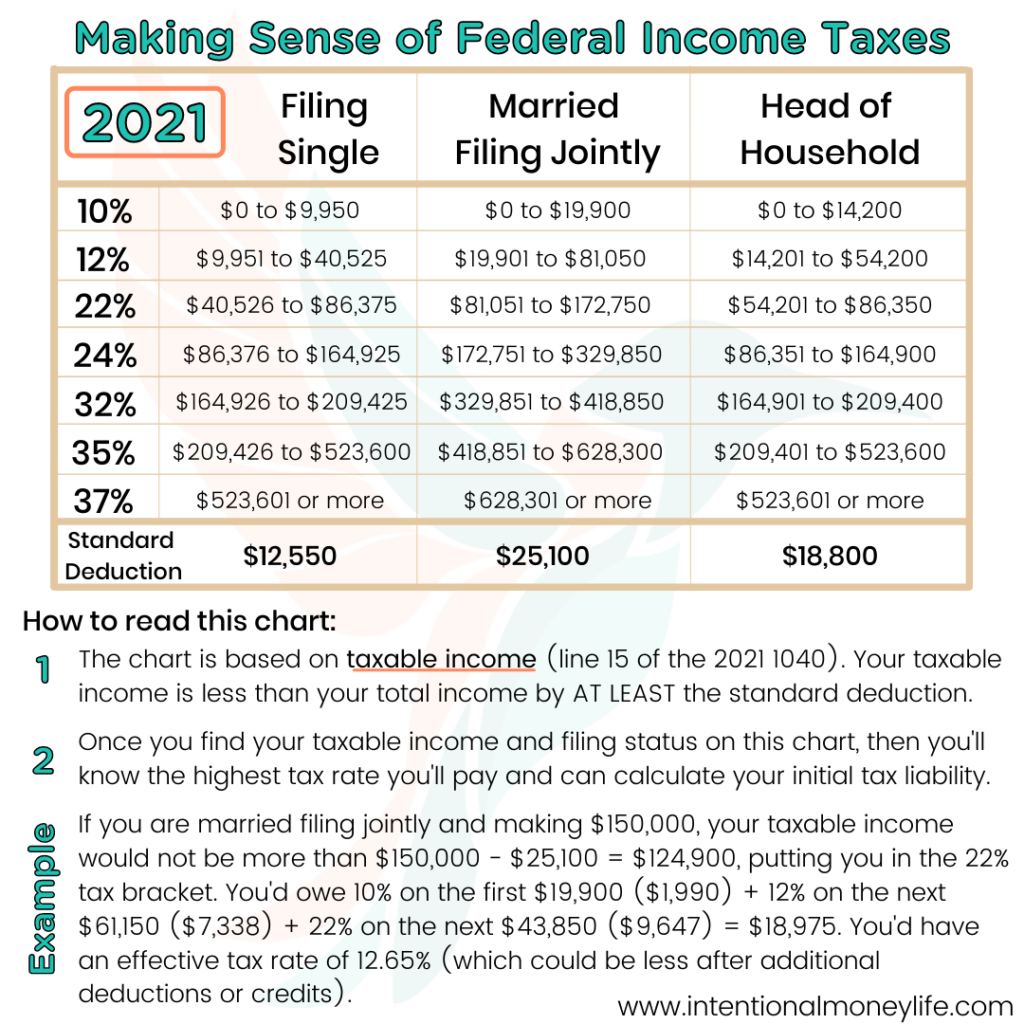

A lot of people don't understand tax brackets, it's okay! You probably saw a simple table for single filers in 2021, and it had rows like this:

| Under $9,950 | 10% |

| $9,950 - $40,525 | 12% |

| $40,525 - $86,375 | 22% |

| $86,375 - $164,925 | 24% |

| $164,925 - $209,425 | 32% |

| $209,425 - $523,600 | 35% |

| Over $523,600 | 37% |

You looked at that and thought well, I was in the 22% and now I'm in the 24%.

But DO NOT do that. Do not multiply the percent to your entire paycheck, do not multiply 86K x 22% and 87K x 24%. If you did that (which, again, you shouldn't!), you would be sad, because it would show you LOSING $960:

| Salary (after deductions) | Tax Rate | Tax | Take Home Pay |

|---|---|---|---|

| $86,000 | 22% | $18,920 | $67,080 |

| $87,000 | 24% | $20,880 | $66,120 |

Luckily that is not the system we have in the US. Our tax rates are marginal. That means you only pay 10% on the first part of your salary - the $9,950. Then you pay 12% on the chunk that's between $40,525 - $86,375. And so on.

How Marginal Rates Really Work

So here's what's happening. When your taxable salary was $86,000, this is how it was taxed:

| Tax Bracket | How much of YOUR salary is taxed at that rate? | Marginal Rate | Tax |

|---|---|---|---|

| Under $9,950 | $9,950 | 10% | $995 |

| $9,950 - $40,525 | $30,575 | 12% | $3,669 |

| $40,525 - $86,375 | $45,475 | 22% | $10,005 |

| Total Tax | $14,669 |

Your take home: deducted income + taxed income - tax

$12,550 + $86,000 - $14,669 = $83,882

With your new salary, only a tiny bit of it is in that 24% range. Here's what it looks like:

| Tax Bracket | How much of YOUR salary is taxed at that rate? | Marginal Rate | Tax |

|---|---|---|---|

| Under $9,950 | $9,950 | 10% | $995 |

| $9,950 - $40,525 | $30,575 | 12% | $3,669 |

| $40,525 - $86,375 | $45,850 | 22% | $10,087 |

| $86,375 - $164,925 | $625 | 24% | $150 |

| Total Tax | $14,901 |

Your take home = $12,550 + $87,000 - $14,901 = $84,649

Now of course you should always consult your tax professional, this website is not a tax advisor. But the way marginal tax rates work, only $625 of your salary falls into that 24% rate. So that's the only part that's taxed at 24%. When you step back and look at it, you're definitely ahead! This $1000 raise has increased your taxes by $233, and you get to take home the other $768.

Taxes vs. Take Home

Yes I know, your tax bill went up $233. Next time you get a $1000 raise your tax bill will go up $240. But you've got an extra $760! There's no need to live in fear of tax brackets, you will never pay MORE than $1000 just for getting a $1000 raise.

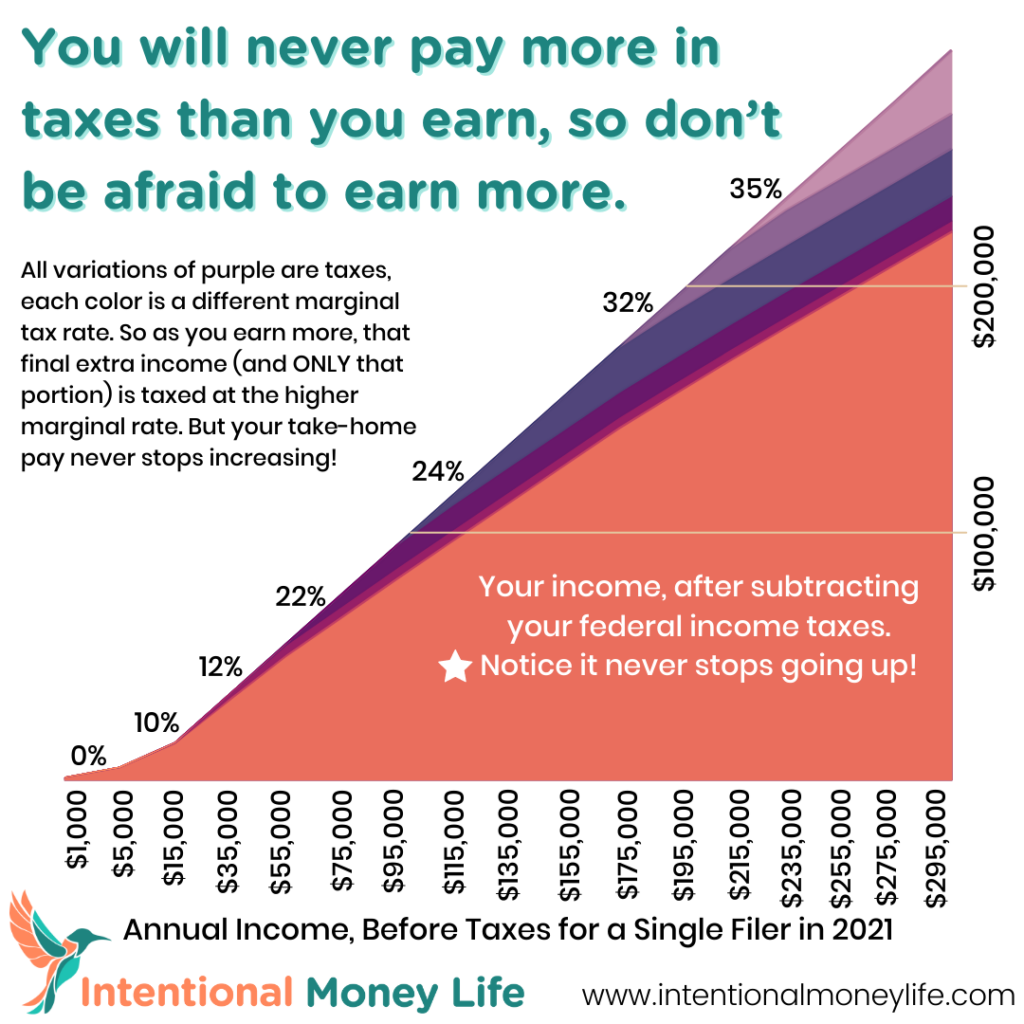

Here's a chart that shows the big picture as your income grows. The salmon at the bottom is your take-home pay. As your salary increases, your take-home pay always increases. There are no sudden drops or stair steps or cliffs to fall off of.

Married? Head of Household?

And here's a table of more federal income tax rates, for if you're married filing jointly or head of household. Head of Household is a status for single taxpayers who have dependents. If you're caring for children or qualified relatives, read up more on head of household to reduce your taxes even further.

Want to learn more about taxes?! Sign up for Michelle's Level Up Your Finances course, that has a module on Demystifying Taxes and another on Optimizing Your Taxes (plus modules on investing and initial retirement planning). Or, do you just want someone to explain it to you, or whichever parts are relevant and how to use that info? If so, you can make a 1-time, 1-hour, advice-only financial planning appointment with Michelle here.

Would you like to move from financial confusion to financial intention?

My courses and programs are for you if you:

- Feel insecure and overwhelmed about finances.

- Are ready to face your fears and conquer money so you can intentionally save, spend, and invest money in line with your values and goals.

- Want to make strategic decisions, then automate your finances.

- Want to invest to grow your wealth and create time freedom, so you can spend your time how you want, rather than working to survive.

- Would love to provide your children with more opportunities and experiences than were available to you.