Do Investment Fees Really Matter?

Do investment fees, such as those for mutual funds, really matter? Is there that big of a difference between 0.04% and 0.75% or 1.5%?

The short answer is yes!

The long answer is below...

[PS - If you don't actually want to learn this information but just want to have a 1-time, 1-hour, advice-only financial planning session with me so you can actually get advice on what to do with your investments, you can make an appointment here.]

Stock Market Basics

First, do you understand the basics of the stock market such as stocks, bonds, mutual funds, active management versus passive index funds, and ETFs? If so, skip to main content. If not, keep reading!

- Stocks – A share of stock represents a small piece of ownership in a company. Stocks are also referred to as equities. You can make money on that stock by either earning a dividend (a regular payout of earnings from the company to its owners, i.e. you) or by selling the stock at a higher price than you paid for it (capital gain).

- Bonds – You essentially loan your money to a company or government. Bonds are also referred to as fixed income, or fixed income securities. You make money because the borrower pays you interest on that debt. Interest is usually paid once or twice a year on a regular schedule.

- REITs – Real-Estate Investment Trusts, are companies that own or finance income-producing real estate. REITs are required to pay out 90% of taxable income to shareholders, therefore you make money on REITs primarily through getting a large dividend payout (and may also make money on capital gains).

- Mutual funds – A pool of stocks, bonds, REITs, or other investments where you own a small part of many things. It helps you diversify, as you can own small portions of hundreds of companies. Diversification can reduce risk, as it means you’re not putting all your proverbial eggs in one basket. It’s also good because it’s really only a handful of companies that drive the growth in the stock market, and the more companies that you own, the more likely you will be to own the few most important ones!

- You can buy and sell shares of a mutual fund once per day, at the daily rate that is decided after markets close.

- You earn money on mutual funds the same way you earn money on the underlying assets, capital appreciation and dividends for stocks, primarily interest payments for bonds, primarily dividends for REITs.

- Managed funds – A type of mutual fund, in these funds one or more managers is trying to beat the benchmark index by buying and selling within that particular pool of assets. Also referred to as actively managed.

- For instance, if the fund focuses on small cap value stocks, in a managed or active fund there would be managers who are pouring over all the various possible companies to determine which ones they expect to do well and which ones they don’t, then they’re only investing in the “better” companies.

- You pay this professional manager (partly) via an expense ratio (investment fees), so a portion of the money you invested. Typically, that expense ratio is 0.3-3%. These fund managers get paid that expense ratio regardless of whether the fund is doing well or not.

- Index mutual funds – An index fund is a type of mutual fund that passively tracks the entire benchmark index, meaning you would own a small amount of every single company in that group, rather than paying a manager to pick and choose certain companies within that index. Also referred to as “passively managed”.

- For example, an S&P 500 index fund will aim to mirror the performance of the S&P 500 (the top 500 companies in the US) by holding stock of all the companies within that index, in proportion to the market weight (market share) of that company.

- This greatly reduces the expense ratio, to 0-0.3%.

- When in doubt as to whether something is an index fund or an actively managed fund, the expense ratio will likely give you your answer.

- This is how you can ensure that you own the few specific stocks that drive the overall stock market growth!

- ETFs – An ETF or exchange-traded fund is similar to a mutual fund, where you purchase small amounts of a large variety of things in each share. However you can buy or sell it like stocks, so the price fluctuates throughout the day, rather than buying and selling at the one daily price that is decided after the markets close.

- Often, ETFs are passively managed and based on the index, but they are occasionally actively managed.

- ETFs are more “tax efficient” and often slightly cheaper than the similar index fund, making them particularly attractive in taxable brokerage accounts (the type of account that isn’t a retirement account).

Fund Expenses (Investment Fees)

Okay so now that you have an overview of these types of investments, let’s talk about the fund expenses.

There are two main types of mutual fund expenses:

Annual fund operating expenses – These are ongoing fees toward the cost of paying managers, accountants, legal fees, marketing and the like. When looking at a fund, this is called an expense ratio.

Shareholder fees – These are sales commissions and other one-time costs when you buy or sell mutual fund shares. These include Sales Loads such as front loads or front-end loads (a fee when you buy it) and deferred sales charges, back load, or back-end load (a fee when you sell it), redemption fees, exchange fees, account fees, and purchase fees.

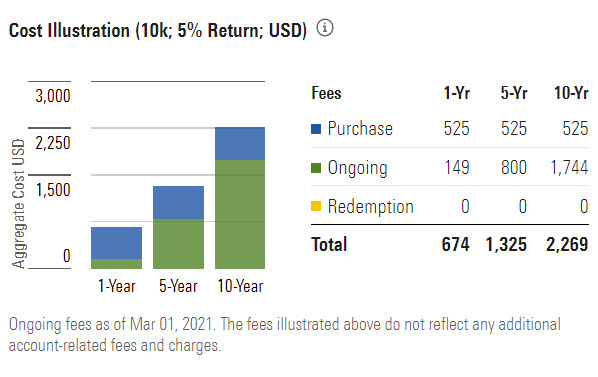

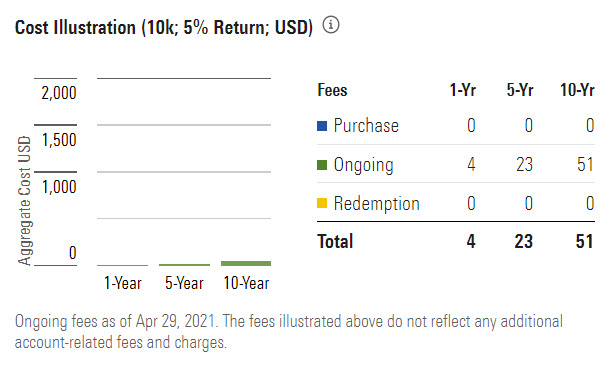

The first example is for the investment fees charged by a mutual fund called Alger Emerging Markets A (ticker symbol AAEMX). When you look it up on www.Morningstar.com (a great place to research funds and stocks), you’ll see there’s a front load of 5.25% and expense ratio of 1.55%.

So when you initially make the purchase, right off the bat over 5% of your investment goes away to fees, which means you have less money to grow in the first place. Then you’ll pay an ongoing fee of 1.55% on your invested money, each year.

Compare that to the Vanguard Total US Stock Market Index fund, which doesn’t have a front load fee, and charges 0.04% annually.

To me, these expense ratio examples make it incredibly clear as to why we should focus our investing life on long-term investments that carry very low fees, such as index funds or index ETFs, and saving money on investment fees.

Q: But wait, why would you choose an index fund instead of actively managed mutual funds, where you can focus on the best companies and avoid the rest?

A: Well, just like you can’t know the future, neither can fund managers. So they’re doing their best to guess what will happen, and they know a lot about the market, but they can’t guarantee anything, because they can’t see the future.

Q: But, if they’re highly educated and understand the stock market inside and out, shouldn’t they at least do better than someone who knows nothing and just invests in everything?

A: No, actually! Data shows that actively managed funds, in the long run, almost NEVER beat the index!!! For instance, check out this article that pulled data from Standard & Poor’s Indices Versus Active Funds Scorecard, and found that among mutual funds investing in large companies, 81% failed to beat their index for 3 years, and 92% after 15 years! Would you knowingly give your hard-earned money to a friend to invest for you if that friend had a track record of doing worse than the stock market 4 out of 5 times? And would you pay your friend for the luxury of having them give you less returns than you could have gotten otherwise? Because I certainly wouldn’t. And the one guarantee from investing in mutual funds, is that you’ll pay the investment fees, which is typically between 0.3% and 3%.

Q: Paying 0.3% to 3% doesn’t sound like so much, though, right?

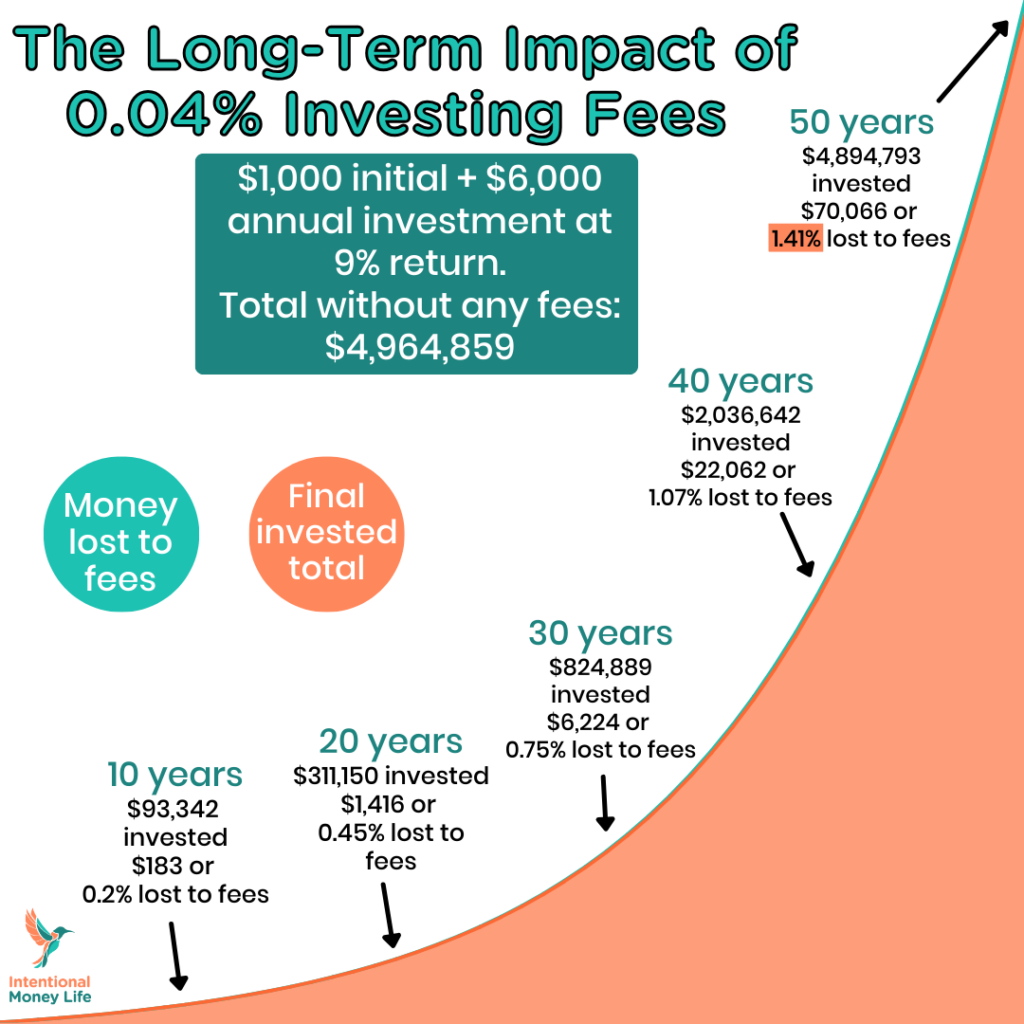

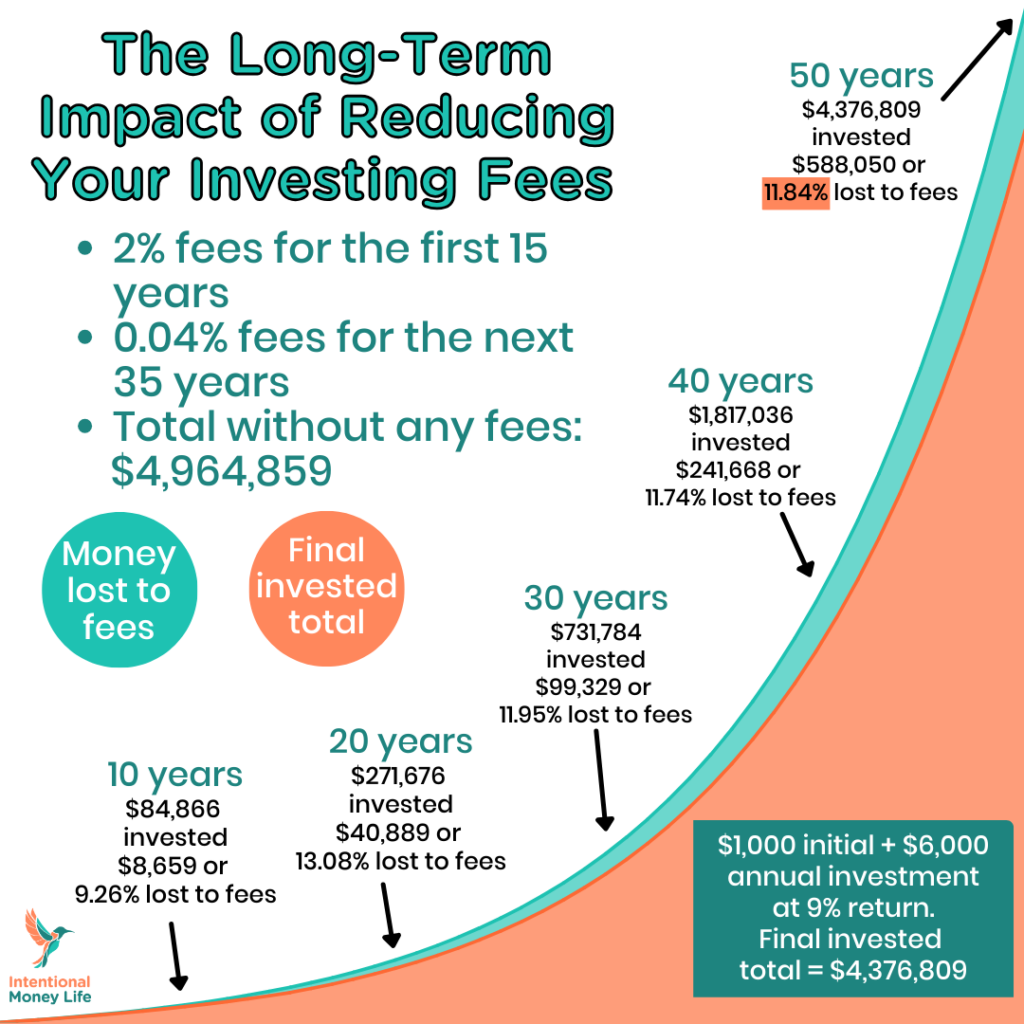

A: Well, just as compound interest makes your money grow exponentially over time, the lost growth in your investments also compounds over time (this is assuming that your particular mutual fund performs the same as the index fund before fees).

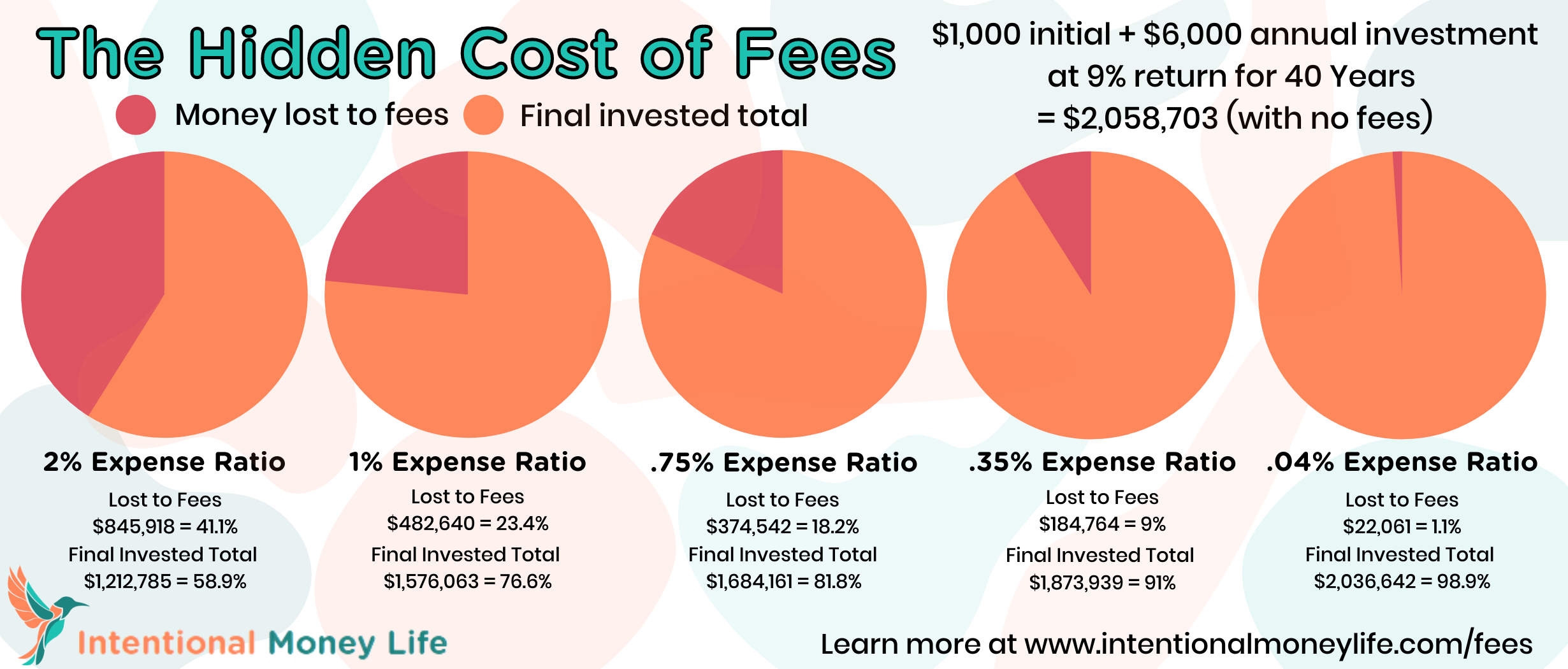

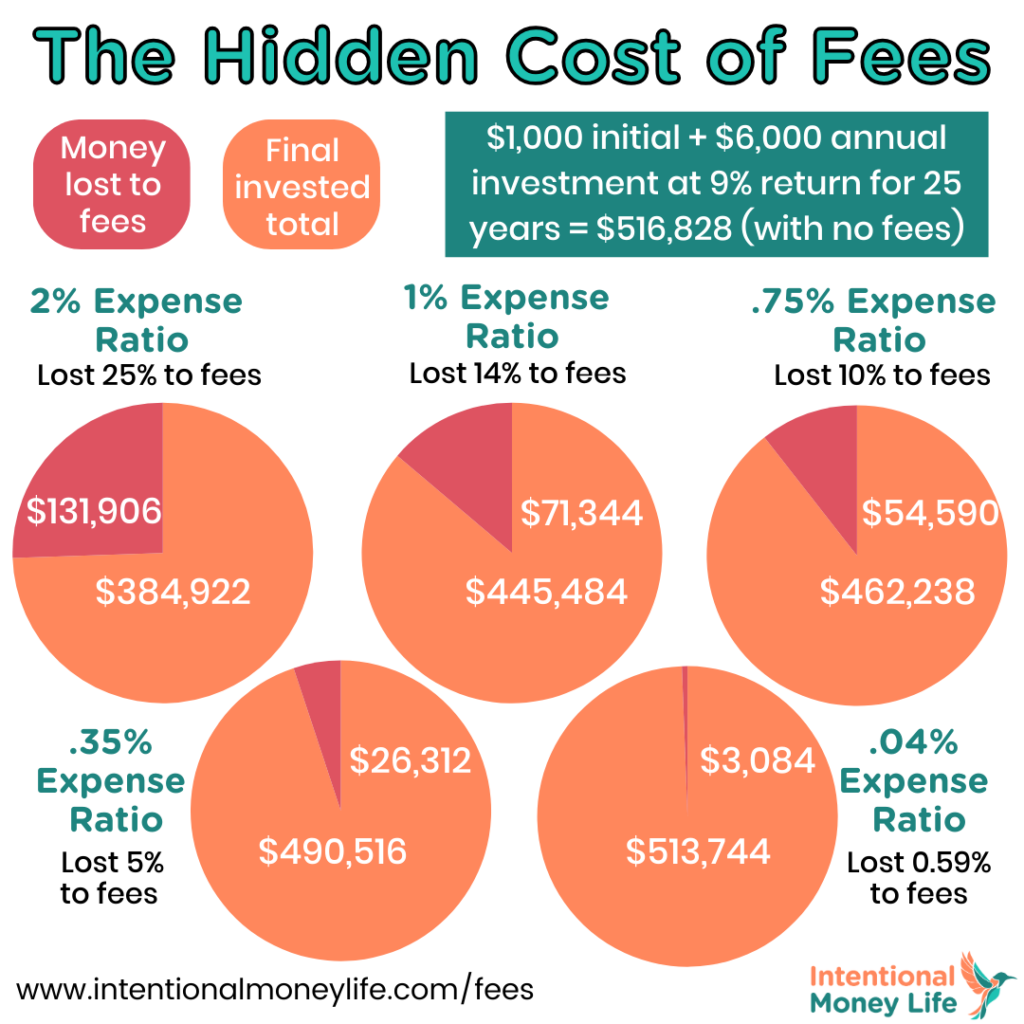

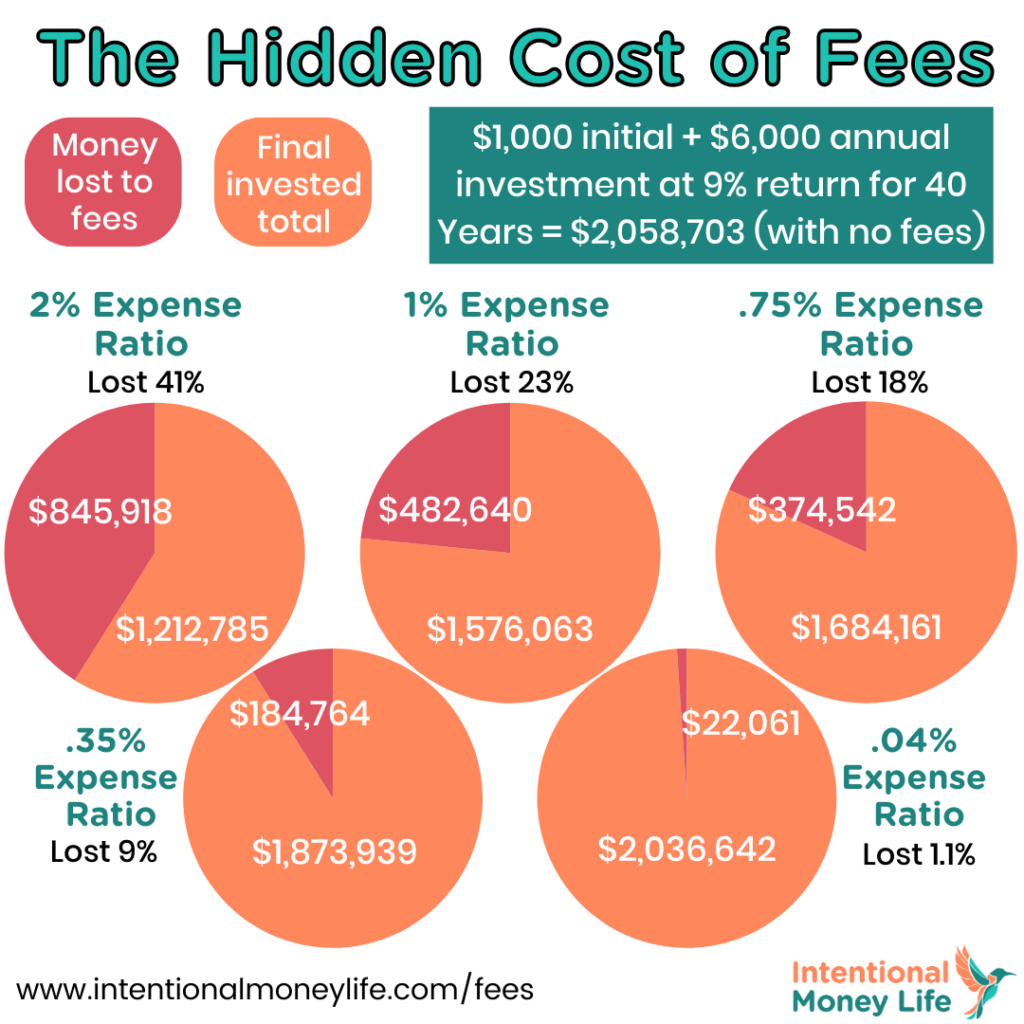

For instance, check out the pie charts below. If you were to start with $1,000 and add $6,000 each year to your investments, with a 9% return, after 40 years you would have just over 2 million dollars.

But if your return gets reduced, even by just a little, due to the investment fees, you can start to lose a lot of your potential money! For instance, with a 2% expense ratio, effectively reducing your return from 9% to 7%, you would lose 41% of the money you could have had! From just a 2% expense ratio! With a 1% expense ratio, you would lose 23%, and even with a 0.35% expense ratio you would lose almost 9% of what you could have had!

Q: Okay, so I understand that fund managers often don’t actually beat the stock market, and that they are expensive and their fees eat into my returns. But what about the fund managers that do beat the market?

A: In the same article linked above, they examined what happened when pension funds hired new managers. They chose managers who beat the index for the past 3 years, yet found that those same managers could not replicate that performance after being hired.

Q: Okay, so what about the ones who have beat it for the last 10 years?

A: Here’s where I think people should probably just come to their own conclusions.

There are some fund managers who will beat the market year after year after year.

Does that guarantee that they’ll continue? No, of course not.

Is it worth it, to you, to invest in only those specific funds, that have low fees and that have a long track record of beating the rest of the market?

That’s going to be a very individual answer. I have chosen not to, because there are a variety of reasons why I think each year it can be harder for them to continue to beat the market. I also don’t like the idea of “buying high”, which is essentially what you do when you decide to invest in a mutual fund that is already doing really well. But I also think that, as long as you aren’t putting everything into that fund, you can decide what to do with your money. Just remember that the only guarantee is that you’ll pay that expense ratio. Hindsight will be 20/20, but we can never know for sure which fund managers will definitely beat the index (by enough to give you a higher return after their expenses). So at least if you choose to go this route, it might be best to only do so with a smaller portion of your invested money, and try to stick with funds with low expense ratios/investment fees. Also, it would be ideal to really understand the fund manager or managers, and what they’re investing in.

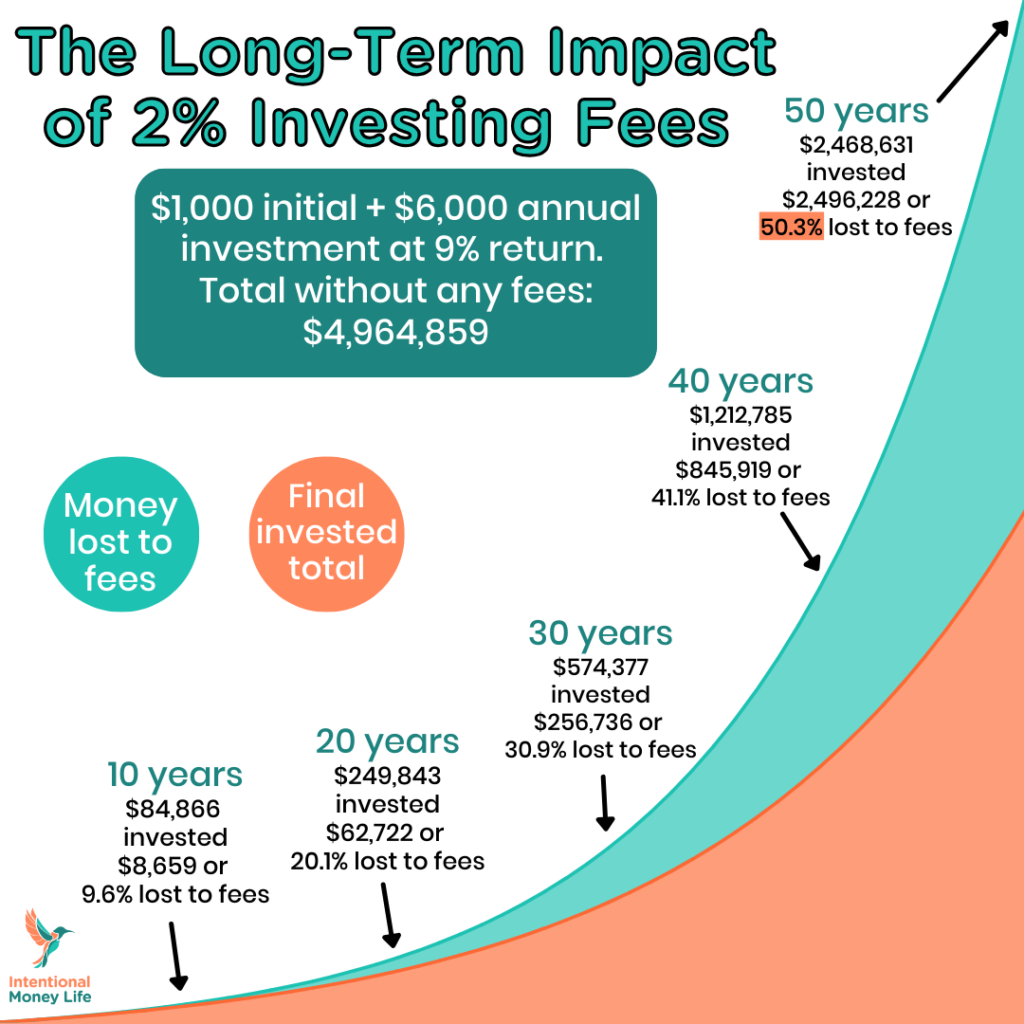

So if managed funds is the way you want to go, you’ll need to educate yourself on the stock market in much more detail than otherwise needed! Note too, that if you are investing more money (or over a longer time period), the fees will have a larger impact.

So if you are a high earner like a physician, the impact of fees can be huge. Check out this great article about the impact fees could have on physicians investments and consequently retirement situations: Click here to read

One final note: If you have been investing within managed mutual funds with high fees and wonder if you should switch your money, know that just as compound interest/growth makes a bigger difference over a longer time horizon, the same with fees. So if you’ve been investing in non-ideal funds for 10 years, but still have 10, 30, or even 50 years left in your investing life, go ahead and make that switch! You may still save a ton of money over time! [See the below images to see why!]

Are you ready to start investing in index funds or index ETFs? Check out my blog post that walks you through some of the biggest questions you’ll need to answer to go ahead and open something like an IRA and start investing! If you know you need more help than a blog post, consider my Level Up Your Finances course. You are also welcome to reach out to me on Instagram @intentionalmoneylife.

PS – This is for educational purposes only and not to be taken as investing advice. If you’d like investing advice, you can get that from a 1-time, 1-hour financial planning appointment with me. Sign up here.

Are you ready to start investing (or maybe you already are), but it's all so overwhelming and confusing and you're terrified you'll lose everything?

- Learn 10 critical lessons that every new (and not so new) investor needs to know

- Gain confidence in your ability to invest successfully

- Avoid investing mistakes that could cost you big time

- Get started investing so you don’t miss out on valuable compound interest