I want to invest, but I have no idea where to start... Help please!!

First, do you understand investing?

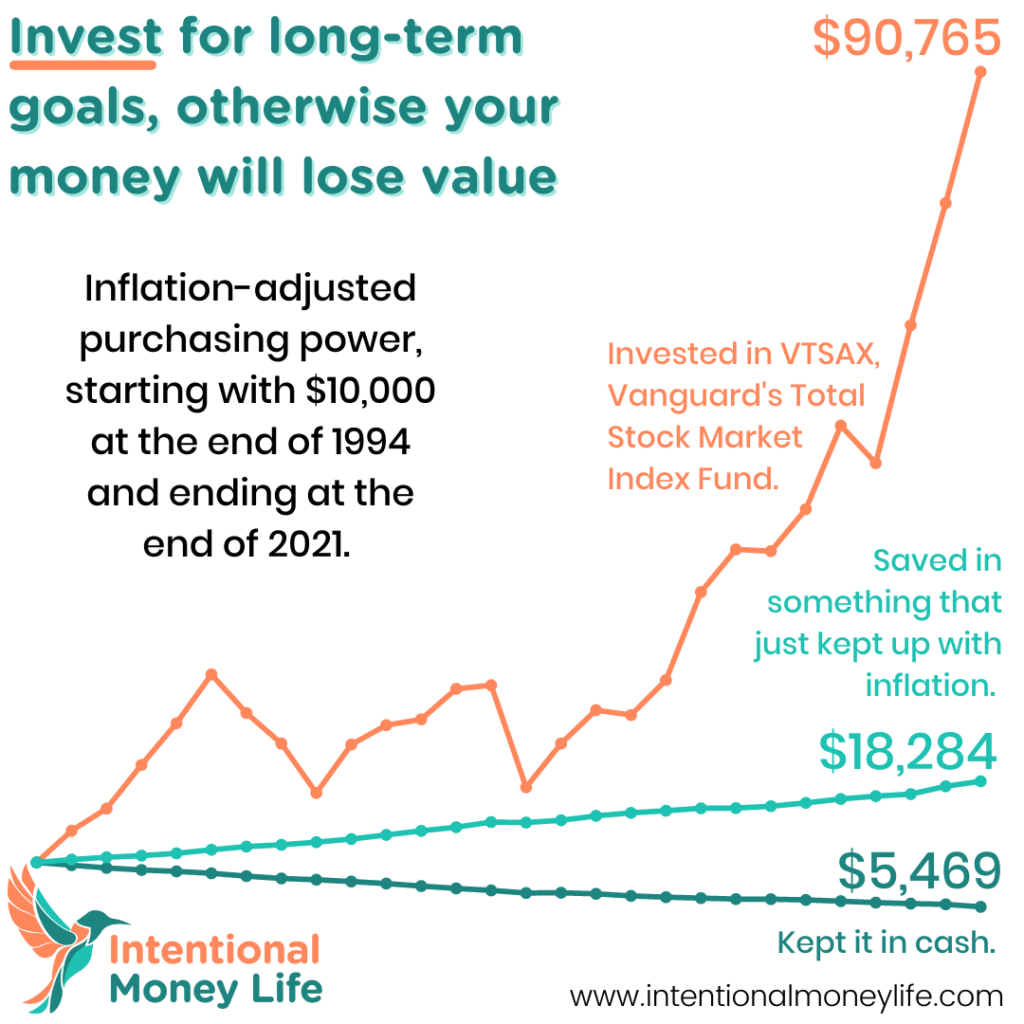

Do you feel good about your investing knowledge? Do you understand WHY we should invest for long-term goals? Are you aware of the impact of inflation on the buying power of your money in the long-run? Are you worried about the stock market being "too high," and trying to figure out how to get into the market at the "right time" then sell before a market down-turn? Are you worried about how risky it is to invest? All of these topics and more are covered in my YouTube video, taken from my Level Up Your Finances course.

If you need a refresher on any of those things, go watch the video and then come back to learn more!

Okay, I understand why I should invest! But what do I invest in?

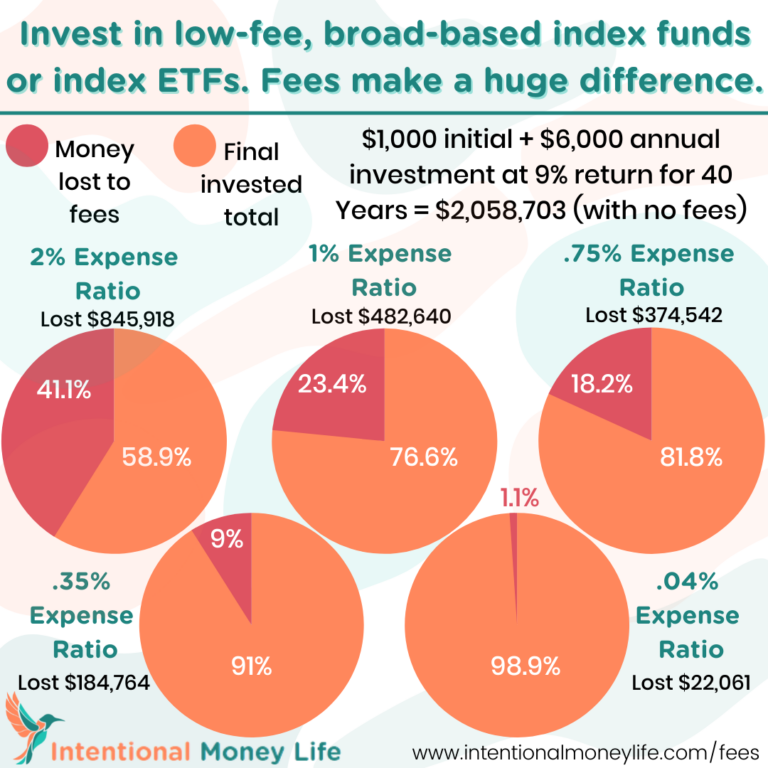

I recommend index funds or index ETFs. These allow you to be very diversified, because you're invested in a huge amount of companies through just one fund. And because they're based on the index, you are paying very little to invest in them, and you'll get the average return of that index. Does all of this sound like a foreign language to you?

If so, go check out my blog post on the impact of investing fees and why I recommend index funds. It’s okay, I’ll wait right here for you to come back.

[Alternatively, you can sign up for a 1-time, 1-hour, advice-only financial planning appointment with me here.]

Great, I want to invest in index funds or index ETFs. Where?

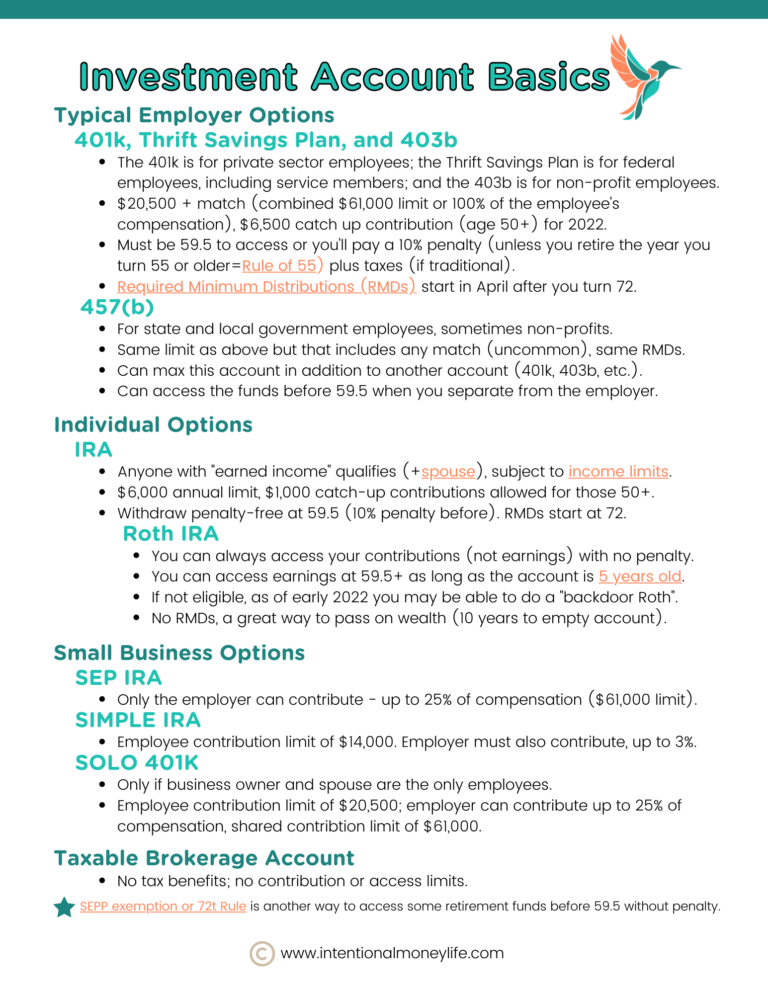

So the first "where" to understand, is what type of account you'll be investing in. It could be a work-related retirement account, such as a 401k, 403b, 457, TSP, SEP IRA, etc. Or it could be an individual account that you can open on your own, such as a traditional or Roth IRA (note limits for each!). It could also be something different, like a taxable brokerage account, a 529 educational savings account, a minor's account such as a UTMA, or various other options.

The type of account you are investing in will likely impact your investment options. I’ll get into investing inside a work-related retirement account in another post, so let’s focus on something like an IRA or a taxable brokerage account, where you can open the account yourself, and you can choose what to invest in.

Sounds good. So where should I open my IRA or taxable brokerage account?

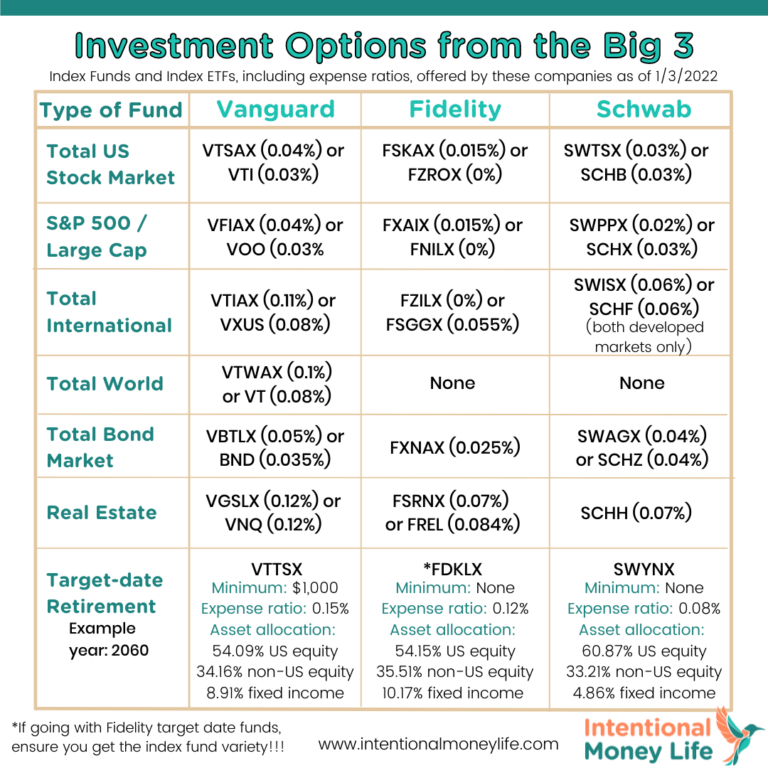

Great question! The biggest contenders for most people are Vanguard, Fidelity, and Schwab. Check out my visual to understand some of the things to consider when trying to decide between these 3 options.

The basics are that Vanguard isn't great if you're starting with a small amount of money, like less than $3,000 for each index fund you'd like to invest in. It may also not be best if you primarily plan to invest in ETFs, because they don't allow you to buy partial or fractional shares (whereas you can get those from both Schwab and Fidelity). Finally, not everyone loves their user interface. But you can get great index investment options from any of these 3, so it really just comes down to your situation and your preferences.

Something to know, is that if you want to invest in index funds, you'll want to open your account at the firm that offers those funds (ie Vanguard for Vanguard index funds). Whereas if you're interested in ETFs, you can purchase Vanguard ETFs for free, and in smaller amounts, from Fidelity and Schwab. If you decide to go with Fidelity, check out my blog post that step by step walks you through investing, reinvesting dividends, and setting up an automatic transfer + investment with Fidelity.

Are you too overwhelmed to make this decision? Sign up for a one-time financial planning session with me or check out my Level Up Your Finances course for support!

I decided where! Now what do I invest in?

You're making progress so quickly!

Okay, so now that you've figured out where you want to invest, check out the visual for some of the funds you might want to consider. Some of these funds are index funds and some of them are ETFs. When choosing funds, remember to keep it as simple as possible. I would encourage you to learn more about historical stock market performance and compare things like stocks vs bonds using Portfolio Visualizer. You'll want to pay attention to the final balance as well as to the annual volatility when you're deciding how much of your portfolio will be invested into what. The total US stock market is a great main fund to be in, since it has stocks from all the publicly traded companies in the US (though if you prefer, you could just do the S&P 500 instead). Want to have some international investments as well? Great, add a total international fund. Want some bonds? A total bond market fund would be perfect. Keep your portfolio as simple as you can, while meeting your needs! Note that if your asset allocation preferences align with target date index funds, you may be able to choose just 1 target date fund and be done with it!

If you really want to get more into this, such as taking some time to consider whether you want to invest in bonds or international funds, figuring out your desired asset allocation, or considering how to invest in a tax-efficient way by taking advantage of different types of retirement accounts and also taxable accounts, you should check out my online course, Level Up Your Finances.

Are we done yet?

So now that you've made all those decisions, you just need to make it happen! Quick note, before you jump into investing in something like an IRA or taxable brokerage account, it would be good to check on your financial situation. Do you have an emergency fund? Credit card debt? Are you taking advantage of your company match on a 401k if available? Check out my priorities list to make sure you're ready for this step! If you're still a little hesitant about investing, you might benefit from my FREE Investing 101 course, or you may instead really benefit from my Level Up Your Finances course (you can preview some of the content for free too!). You are also welcome to reach out to me on Instagram, I'm @intentionalmoneylife.

If you are ready: open your investment account, connect it to your bank account, transfer money over, then go in and buy the specific fund or funds you want using the ticker symbol (the letters found in the visual of investment options). You may need to wait until the next day, but then the final step is to set your account to reinvest all dividends and capital gains. Additionally, I encourage you to set up a regular contribution/investment, so that you can continue to regularly invest and you don't even have to think about it. If you chose more than one fund to invest in, you'll also want to consider rebalancing your investments every year or so (getting back to your target asset allocation, i.e. 80% total US stocks, 15% international stocks, and 5% REITs, or whatever you decided on). If you decided to go with Fidelity, check out my blog post to help you get everything set up correctly! If you need help with any of this, sign up to meet with me (it's a flat-fee, $150/hour, meeting where I won't be pitching you anything, just helping you get your questions answered)!!

And finally, remember that you should expect the stock market, and therefore your investments, to swing up an down a lot (especially if you are all or mostly in stocks!). That's okay. Just keep going. Invest regularly and whenever you have the money to invest. No matter what the stock market is doing. And just don't sell, for a very, very long time. You've got this!

PS - This is for educational purposes only and not to be taken as investing advice. If you want investing advice, you can sign up to meet with me here.

Are you ready to start investing (or maybe you already are), but it's all so overwhelming and confusing and you're terrified you'll lose everything?

- Learn 10 critical lessons that every new (and not so new) investor needs to know

- Gain confidence in your ability to invest successfully

- Avoid investing mistakes that could cost you big time

- Get started investing so you don’t miss out on valuable compound interest