What New Parents Need to Know about Money - Part 2

So you're a new parent, wondering how to get your financial life in order?

Here is your to do list.

1. If you are part of a couple, get on the same page financially (and otherwise).

2. Build up your emergency fund and possibly reconsider your budget (will it need to change? what will that require?).

3. Re-evaluate your life insurance to make sure you have enough and the right kinds of life insurance, including for stay-at-home parents.

4. Make sure you're set up with long-term disability insurance for anyone whose income supports the family.

5. Start your estate planning, at the very least making sure to have a will that designates guardians for minor children.

6. A few other loose ends to consider, such as adding your baby to your health insurance, updating your beneficiaries, getting on childcare wait lists if needed, and more.

7. Make sure you have a solid investment plan for yourself, and start an investment account for your child! Learn more in What New Parents Need to Know about Money – Part 1.

Get on the same page with finances

For those of us who are coupled when we become parents, it's really a time to become a team if we want to thrive. This relates to most things, and that includes finances. If we don't know what we (individually and collectively) want, how can we work together to get there?

Having a child with someone is likely to mean all sorts of changes, from managing the dynamics of the increased household workload, to managing increased costs and/or decreased income. If we don't face these things as a team working towards the same goals, it can pull us apart. And honestly, we don't need another thing pulling us apart!

You get to decide how you want to approach these conversations, but I would suggest you start by learning more about yourselves, and coming together to talk about what you're learning. is a great place to start!

Build up that emergency fund!

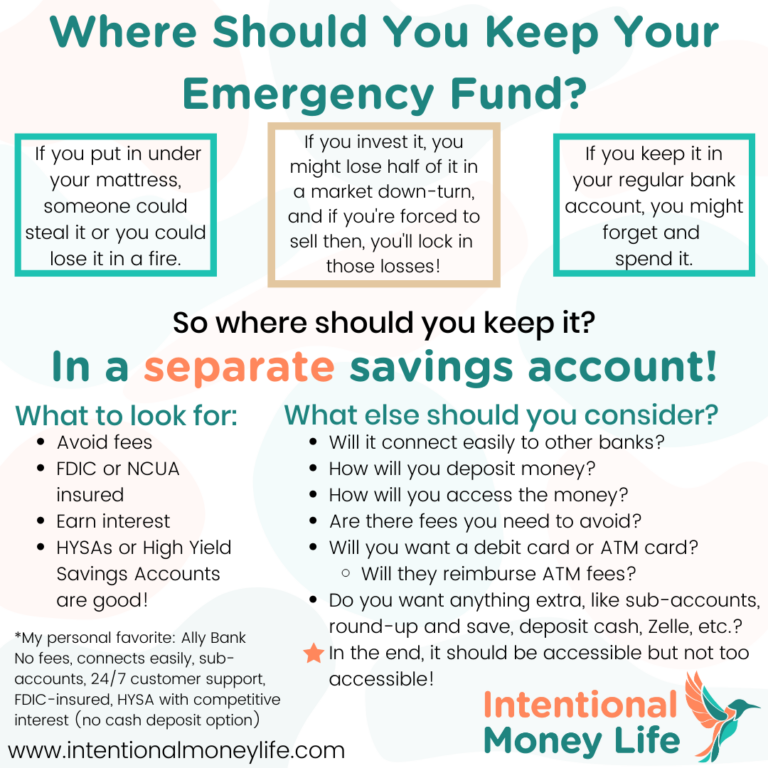

Once you know that you want to have kids in the near future (or have them), you might want to check to make sure your emergency fund is really solid. You may end up with unexpected bills, your living costs are likely to go up, and now you're responsible for an entire new human, so it's a good time to re-evaluate to make sure it's solid.

At a minimum, I would say 3 months of necessary living expenses are needed, but I'd probably want to be closer to 6 months (or maybe more, depending on your situation). I appreciate this article for helping you think through some of the factors that can help you determine what kind of emergency fund you need.

Ideally, the fund should be in a separate, FDIC-insured savings vessel, such as a savings account, where it’s making as much interest as possible (High Yield Savings Accounts can be a decent option).

Make sure you have sufficient life insurance

As much as we hate to think about it, there is a real (though very small) possibility that we might pass away while our children are still young and financially dependent on us. If we just take the simple step to purchase life insurance, at least we know that we won't leave our family to struggle financially in addition to everything else.

The good news about this type of insurance, is that we only need it for a limited period of time. Eventually, our children/partners won’t rely on us financially and/or we will build up our own accounts and self-insure. So we only need life insurance until then. And because statistically speaking, we aren’t actually likely to die in that time period, term life insurance is actually a pretty inexpensive (assuming we get it when we’re still young and healthy, without a dangerous job or hobbies) way to protect our families.

How much life insurance do you need?

There are many ways to do it. Personally, we chose to carry enough life insurance that the surviving parent would be able to stop working if they wanted or needed to (so they’d be in a position to make work-optional). So between our current investments and our life insurance, we wanted to get to $1 million, which would allow us to take out about $40,000 annually (following the 4% rule).

Then on top of that, if the kids were still minors, there would be the Social Security benefit that would also help out (you should definitely log in to the Social Security website to see if you and your partner are currently eligible for that benefit and if so, how much your child and person caring for said minor child would receive!). And because we’re working on increasing our investments, we chose to ladder our policies instead of getting one big policy for the entire time we might need the life insurance. So we have a 10 year policy and a 20 year policy, and a plan to be at at least $1 million in investments by the time the longest policy runs out.

Another option that is commonly recommended is to get 10 times your annual salary. Of course if someone intends to be a stay-at-home-parent and therefore not bring in a salary, remember that your time/labor will be expensive to replace. So even those who aren’t bringing in money should have life insurance so that surviving partner could afford to hire help (or quit working, if you think like I do).

Don't forget insurance for your income, i.e. long-term disability insurance

This is actually the insurance you're statistically most likely to use, so this is a super important one that shouldn't be overlooked. This kind of insurance is basically insurance for your income, which of course is important for anyone who depends on their own income to pay the bills, or who has someone else who depends on that income (i.e. most of us).

Of course the worst part about this kind of coverage is that because it’s so much more likely to be used, it’s also more expensive to get. But just like with life insurance, the longer you wait the more expensive it might become. So if you don’t have this by the time you have kids, it’s a really good time to get it!

Time to do some estate planning!

Back to that unlikely but disastrous possibility that something could happen to you. You really need to do some estate planning! You'll want to meet with an estate planning attorney from your state to figure out exactly which documents you need and get it done, but this is a task that I hope you won't put off. If anything does happen to you, you want to make sure there is a plan in place for your children, if nothing else.

Okay this is enough adulting and I'm exhausted, are we done yet?

Those were some of the big things to make sure you do. Here are a few smaller things to consider:

– You likely only have 31 days to add your baby to your health insurance! Make sure you do that!!!

– Check on and update your beneficiaries on your various accounts.

– Will you need childcare? Do you need to get on any waitlists? With my first child, I got on the waitlist for one particular childcare center in July of 2015 (well before I was pregnant). Come November of 2017 when my child was born, they did not think they’d have a space for me (in January a space did open up).

– Do you have access to an HSA or FSA? You might consider contributing if you haven’t before, or re-evaluating how much you want to contribute.

– Consider submitting a new W4 tax withholding form, otherwise you may end up withholding too much of your income (which is fine, if that’s your preference, I just prefer to keep my money throughout the year instead of letting the government hold on to it for me). You can use the Tax Withholding Estimator to help you figure out how to fill out the form to withhold the appropriate amount.

– Don’t forget to start an investment account for your child! Remember that we don’t want to save for long term goals, we want to invest! So if you want to set aside money (even just gift money) that your child won’t be using for 10+ years, invest that money! You can learn more in What New Parents Need to Know about Money – Part 1.

Want to hear more? Check me out on the Baby Pro Podcast episode, Are You Financially Fit When Raising a Family?

You can always reach out to me on Instagram if you have any questions, I’m @intentionalmoneylife. And if you want to set up an appointment with me, so that we can talk about all of these things (or other financial and investing-related concerns), you can schedule with me here. Note that everything on my blog is not “advice” however I can give you advice in a meeting! So sign up if that’s what you’re looking for!

Would you like to move from financial confusion to financial intention?

My courses are for you if you:

- Feel insecure and overwhelmed about finances.

- Are ready to face your fears and conquer money so you can intentionally save, spend, and invest money in line with your values and goals.

- Want to make strategic decisions, then automate your finances.

- Want to invest to grow your wealth and create time freedom, so you can spend your time how you want, rather than working to survive.

- Would love to provide your children with more opportunities and experiences than were available to you.