What New Parents Need to Know about Money - Part 1

New parents! So you’re a new parent (or you were at some point). What should you do to set your child up financially for the future?

There’s a lot that new parents need to think about. Beyond trying to figure out how to get a newborn to sleep or eat or maybe stop crying, there’s a lot that new parents need to do! Someone now depends on you, and that’s a lot of responsibility!

But just like your newborn didn’t come with a handbook (which would be amazing), it’s confusing trying to figure out what you need to do. I can’t guarantee that these two blog posts include everything that you need to know, but they’re a good start at least.

And if what you want is not a blog post, but just a 1-time, 1 hour, advice-only financial planning session where we can talk about these strategies and how to implement them (along with answering your other questions), you can schedule one with me here.

Invest, don't save.

Let's start with the most exciting part (to me anyway), and that’s creating a way to invest for your child's future. Often, new parents feel like they’re really on top of it when they open a savings account for their child. And that is totally great… but at the same time, if the intention is for them to not use the money for at least 5 years, a savings account or other savings vessel really isn’t the best place to put it. That’s because of two things, inflation and opportunity cost.

So for inflation, realize that $100 in 2004 terms would actually only buy you $67 dollars-worth of things at the end of 2021. Put another way, you would need $143 at the end of 2021 to buy what you could get with $100 in 2004. Because inflation is usually between 2 and 3% annually, if you’re saving money for your child anywhere that pays less than inflation, you are losing purchasing power in the long run.

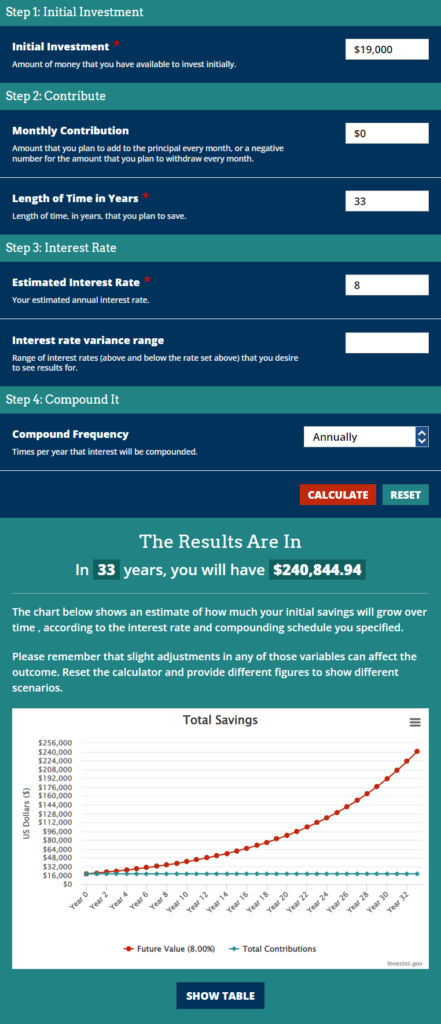

As for opportunity cost, when you choose to save money instead of investing it, you miss out on the opportunity to grow your money. For instance, if you had a child in 2004 and immediately put $3,000 in a savings vessel that kept up with inflation, you’d have something like $4,300 at the end of 2021. If instead you invested that in the Vanguard total US stock market index fund, you’d have $19,000. And of course, if you continued to leave that money for even longer, it could make an even bigger difference. Maybe your child leaves that money until they’re 50 years old. If they get an 8% return on that $19,000 from 2021 going forward, they could have $240,000 at 50 years old — all from a $3,000 contribution! Of course this is just an example, and beyond that $19,000, it’s theoretical. But I hope it helps to show you why you might want to invest for your kid’s future rather than save for it. (Check out the image from investor.gov.)

Okay so now you want to invest for your child, but where do you do that?

To me, the primary account types to consider would be an educational account such as a 529, a custodial account such as an UTMA or UMGA, or just a taxable brokerage account in your own name.

529 Educational Savings Account

This is referred to as a Qualified Tuition Program by the IRS. A 529 gives you the opportunity to invest for education-related expenses, without having to pay taxes on those investments annually. Additionally, you can take the money out penalty and tax-free as long as you use it for qualified expenses. Some examples of qualified expenses include some K-12 private school tuition, tuition and fees at postsecondary institutions that accept federal student aid (so community colleges, universities, trade schools and things like that), potentially room and board, up to $10,000 of student loans, some of the costs of studying abroad, internet while in school, and more. [And there's a new update as of January of 2023 that makes this account even more exciting, it's in the last paragraph of this section!]

Each state offers a 529 plan, but you can choose another state's plan. However, note that there be be a state tax deduction or credit for contributions, but that may only apply if you use your state's plan.

The person who opens the account is the owner of the funds. They can always change the beneficiary, however know that only one person can be a beneficiary at a time. This is important because you can only get money out penalty-free for qualified educational expenses for that one beneficiary. This means that you'd want two accounts if there's a possibility you'd want to take funds out for two different people at the same time. Because the parent/account-opener is the owner of the money, it counts against students less for financial aid purposes than an UTMA or UGMA would (for a parent-owned account, up to 5.64% instead of 20%, more on this in the next section).

So basically, if you think your child may one day have any sort of educational costs, a 529 may be a great idea for you (remember to open one per child). [Even if you don't think they'll have educational costs, because of the updates below, I think everyone should probably open this account!] And since you can change the beneficiary, if you can't find any way to use the money for that child, you could always change the beneficiary to another child, a grandchild, or even use it for yourself. You could also choose to take out the money and pay taxes and a 10% penalty.

You can learn more about 529s here.

Important updates!!! SECURE 2.0 Act passed at the end of December of 2022, and it made some really important changes to 529s! Now (starting in 2024), as long as the account has been open for at least 15 years, up to $35,000 can be transferred from the 529 to the beneficiary's Roth IRA (subject to annual contribution limits). So if you were wanting another way to help your kids fund their Roth IRA, this is a great way! You can read about this change on page 6 here.

Another note - if grandparents are considering a way to invest for your children, the FAFSA simplification that is supposed to go into place for 2024-2025 should make a grandparent-owned 529 an even better deal!

Custodial UGMA or UTMA Account

In a custodial account, the child owns the assets, and the custodian manages the account until the child reaches the age of majority in your state. Taxes are paid annually just like in a taxable brokerage account, however because the account is owned by the child, the first $1,050 earned by the child is tax-free, and the next $1,050 is taxed at the child's rate (anything over that is taxed at the parent's rate).

There are two major downsides that I see to this type of account. One, the assets are the child's and therefore they "count" more when applying for financial aid. This is because 20% of the child's assets are considered to be "available" to pay for their education annually, whereas only up to 5.64% of parents' asset are included in the Expected Family Contribution formula (eventually to be called the Student Aid Index). The other downside that I see is that because the assets in the account are the child's, there are rules as to how the money can be spent while they are a child, and you don't get to decide when the child gains full control. This means if the age of majority in your state is 21, once your child hits 21, regardless of whether they are financially responsible or not, they will be able to use the money however they want. This is why I personally wouldn't want to have significant assets in this type of account.

A Taxable Brokerage Account in Your Name

This type of account gives you the most flexibility and control, however it gives you no tax benefits. You open the account, it's in your name so you get to decide how to invest it, how to spend it, and when to give it to your child(ren). Also, because you own it, the assets in it count against your child for FAFSA purposes at up to 5.64% instead of 20%. But, of course, you'll pay annual taxes on it at your tax rate, and you won't get any tax breaks for your contributions. When you do want to give the money to your child, you'll need to pay attention to the annual gift limit of $16,000 per person for 2022 (meaning if you are a couple, you could together gift the child $32,000 for the year), or if you want to go over the limit, it would be part of your lifetime gift tax exemption (currently at over $11m but that could change) and file a gift tax return.

One way that I have heard of people using this option, is to save/invest for their child and eventually use the money to help the child fund a Roth IRA once eligible. For the child to be eligible for an IRA, they need to have "earned income" (taxable compensation) for that year, and the contribution limit will be the amount earned or $6,500 (for 2023), whichever is lower. When your child becomes eligible for an IRA, I strongly encourage you to help them open and fund it (likely the Roth option), however you want to do that! That really is the gift that keeps on giving, since it will allow them to invest the money and let it grow for as long as they want (without any annual taxes), then take it out tax-free as well!

Our Approach

Personally, we have chosen to do a 529 along with a taxable brokerage account in our names.

[Update - And because of the previously mentioned changes to 529 law, we will now stop contributing to a taxable brokerage account for our kids, and will only fund the 529 from now on.]

The 529 allows us to get the small state tax credit for our contributions, save on investment earnings annually, and invest money for education in the future. And it gives us a place to put gift money, or to let others know they can send gift money (which one of the grandparents is taking advantage of and we are very grateful for). And now, it'll help us help our kids fund their Roth IRAs later!

The taxable brokerage account allows us to invest any additional money for our children that we don’t want tied up in education. We pay attention to being tax-efficient, so our annual taxes are minimal. Since our kids are currently almost 2 and 4, we don’t yet know how financially responsible they’ll be at 21, and this way we won’t have to worry about it. Also, one day we can use this money to help our kids fund their Roth IRAs, which will be super fun (you may have noticed by now that I’m a bit of a financial nerd).

Update – Any money that we previously invested in a taxable brokerage account for our children will stay there, and will likely eventually be used to help them max their Roth IRAs when they earn income. But we will stop adding more money and will instead add it to the 529 because of the tax credit on contributions, no taxes on growth, and ability to rollover to a Roth IRA after 15 years.

Another update: As of January of 2024, we have opened a custodial brokerage account for each child, and that’s where we’ll put money that is actually theirs (like gift money) and is to be invested.

So you decided what kind of account(s) you'd like to open, now what?

Regardless of what you invest inside of, I strongly encourage you to choose cheap, diversified, total stock market or total world stock market index fund options. So once you decide the type of account, you'll need to figure out where to open it that will allow you access to the best index funds.

For a 529, you'll first want to check out your state's benefits and plan options, to see if that's the best option or not. For a custodial account or taxable brokerage account, Fidelity and Schwab are great options (Vanguard as well, if there will be at least $3,000 in the account at the beginning).

You can check out my blog post on getting started with investing if you are new to all of this. If you still want more information and guidance, check out my online course, Level Up Your Finances, where I go through all sorts of things related to investing, taxes, retirement, and more. Please don't let decision fatigue stop you from moving forward with this! You don't have to make the perfect decision, you just need to make an informed decision and move forward.

Ideally, once you open whichever accounts you choose, set up an automatic contribution/investment and make sure everything is set to reinvest over time. And then just leave it, regardless of what the stock market is doing! All you'll really need to do is slowly start to switch some of your investments into less risky (less stock-heavy) investments as your child approaches using the funds. But of course, if the funds won't be used anytime soon, there's nothing wrong with investing it all in something like a total stock market index fund!

Investing for YOUR future is also investing in THEIR future.

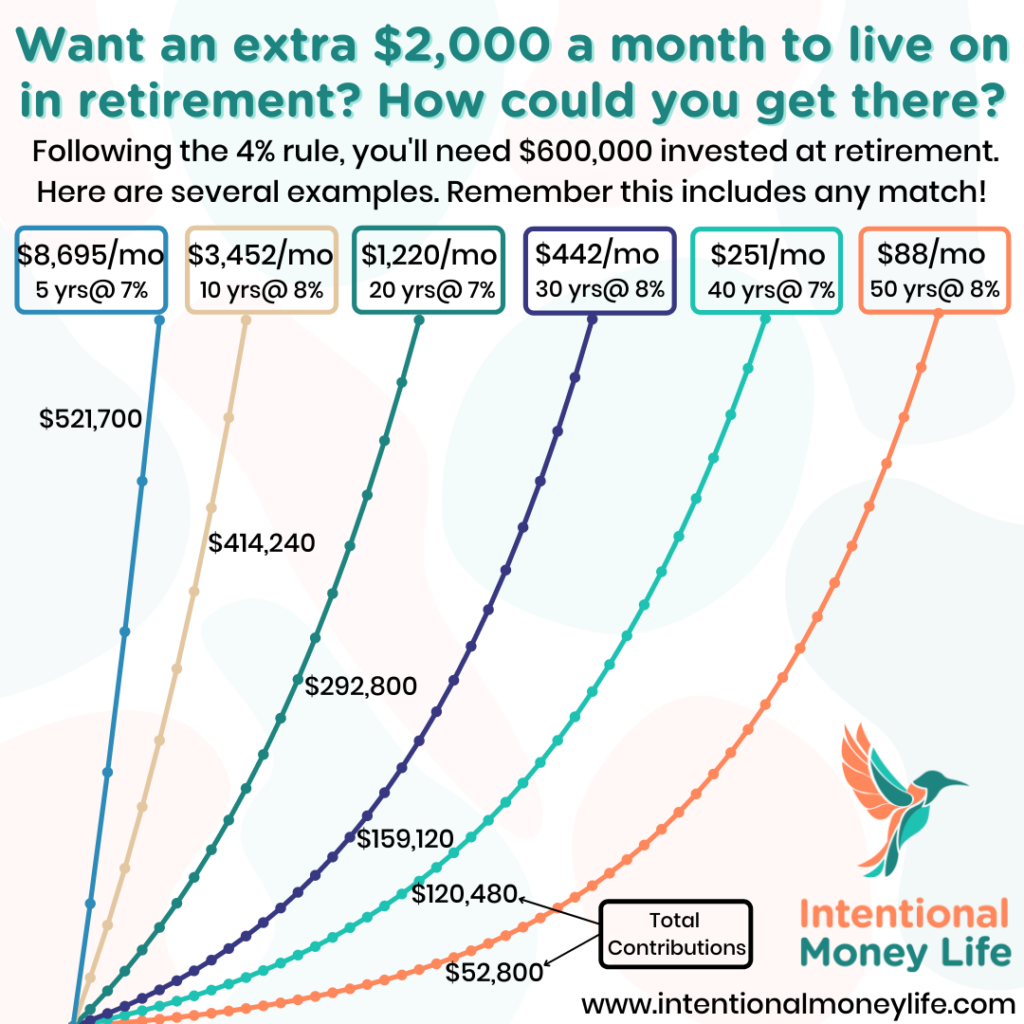

And finally, new parents need to make sure you don’t neglect your own saving and investing in order to set your child up well! Your children can get loans for things like college or buying a house (or you can help them out if you’re doing well financially), but no one will give you a loan so you can retire. So the best gift you can give your child is actually to make sure you don’t end up being financially dependent on them in the future. So make sure you take advantage of your 401k/403b/IRA/whatever retirement account you may have access to (at the very least, get any employer match, but ideally contribute more than that!). If you haven’t started saving and planning for your retirement, it’s time to start! If you need more resources, check out my blog post on prioritizing your finances and my Level Up Your Finances course. You can also follow me on social media for all sorts of financial education. Feel free to reach out on Instagram with any questions, I’m @intentionalmoneylife.

PS – This is for educational purposes for new parents and not to be taken as investing advice. If you would like investing advice, sign up for a financial planning session with me here.

Are you ready to start investing (or maybe you already are), but it's all so overwhelming and confusing and you're terrified you'll lose everything?

- Learn 10 critical lessons that every new (and not so new) investor needs to know

- Gain confidence in your ability to invest successfully

- Avoid investing mistakes that could cost you big time

- Get started investing so you don’t miss out on valuable compound interest