I Want to Invest with Fidelity - What Do I Do Now?

So you decided to invest with Fidelity, but it's all so intimidating! What next?

As you probably suspected, the first step in investing with Fidelity is to open the account. So you'll want to decide what kind of account you want to open. For most people, they'll be opening a Roth IRA, Traditional IRA, or Brokerage Account. Note that there are rules from the IRS around contributing directly to a Roth IRA and contributing to and deducting contributions to a traditional IRA, so check those before you open either of those kinds of accounts! If you already have and max an IRA (and you're already maxing out any employer-offered retirement accounts if available), then chances are you're looking to open a brokerage account, which is just a regular, taxable account where you can invest. If you're not sure what kind of account you want to open, you can learn a little more about this decision in my quick YouTube video. Check to see if they have any special offers here.

If you haven't actually decided if you want to open an account with Fidelity, you can learn a little about the differences between Vanguard, Fidelity, and Schwab here. If you want to invest but aren't quite ready to make all of these decisions to start investing with Fidelity now, you might check out my blog post I want to invest, but I have no idea where to start… Help please!! If you're ready to move forward with opening your Fidelity account and starting to invest, keep reading!

[And if this is all overwhelming and you just want to meet with me and get help, you can sign up here for a 1-time, 1-hour, advice-only financial planning session.]

Open your account.

I’m going to assume that you are ready to move forward, know what kind of account you’ll open, and are ready to open it with Fidelity. When you go to open the account, there’s one question that seems confusing, and that’s which “core position” you’d like to choose. A core position is just where the money goes once you transfer it into the account, before you invest it. It honestly doesn’t matter much what you choose, because hopefully you’ll be investing money as soon as it hits your account anyway. So choose whatever you want. I have chosen SPAXX for no real reason at all.

Go ahead and open your account now. Below, I’ll post detailed instructions with screenshots, as to what you’ll need to do to get your money successfully invested (using the full Fidelity website as viewed from a laptop).

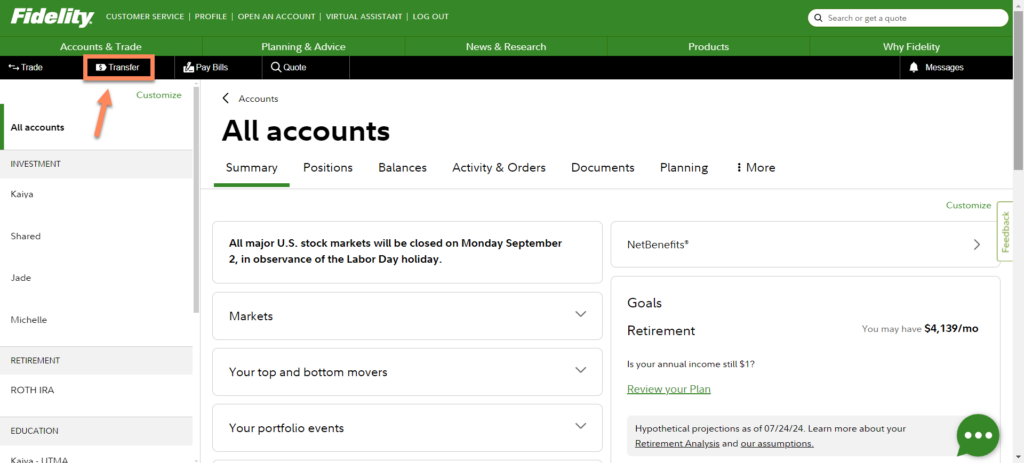

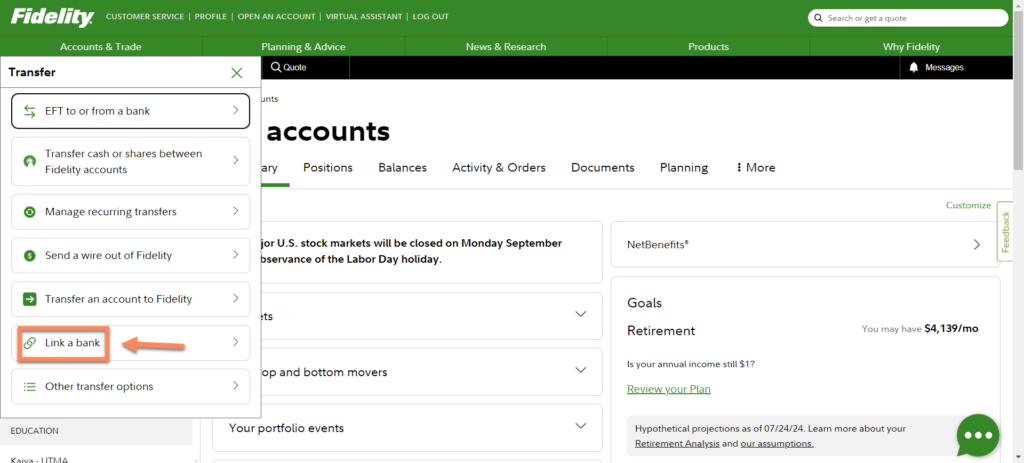

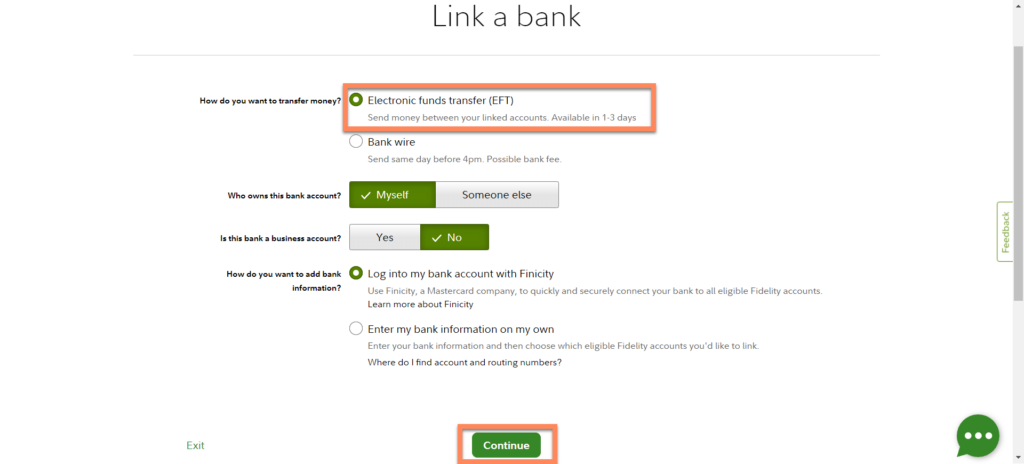

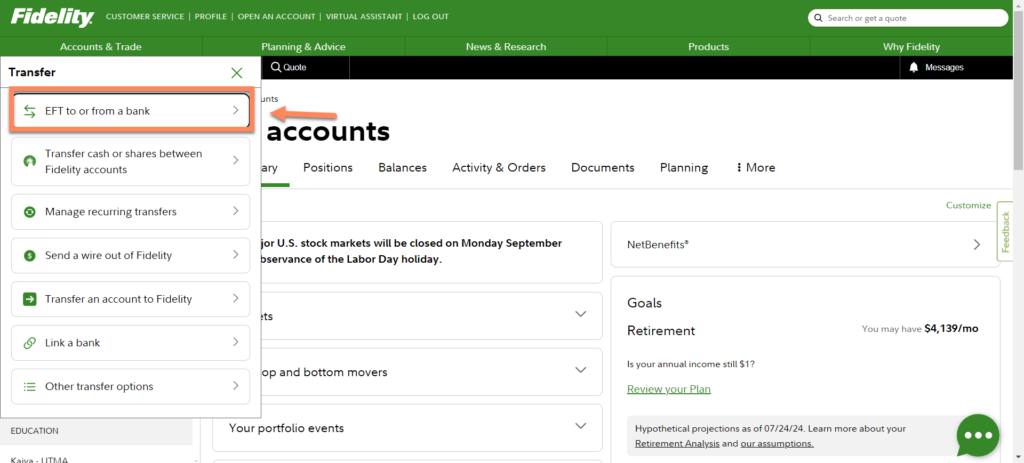

Connect your bank account.

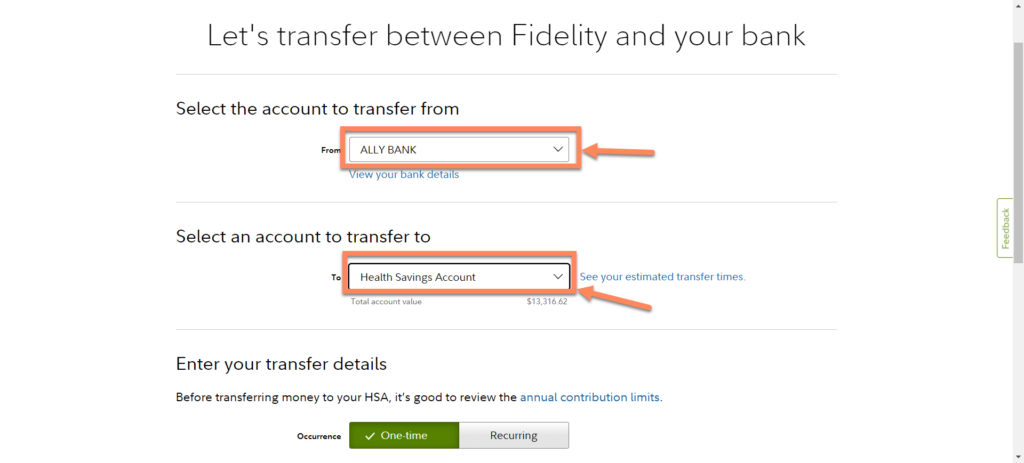

Next, you'll need to connect your bank account so that you can transfer money. From the website you'll click on "transfer" in the black bar across the top. Then you'll select "link a bank" and keep answering their questions (usually using an Electronic Funds Transfer or EFT). Check out the screenshots to follow along. [Note that you can click on any of the images to enlarge them. You can also download them.]

Decide what to invest in.

I strongly recommend index funds or index ETFs. If you are unfamiliar with these terms, or with the idea of choosing index versions versus actively managed funds, check out my blog post on the impact of fees, Do Investment Fees Really Matter?

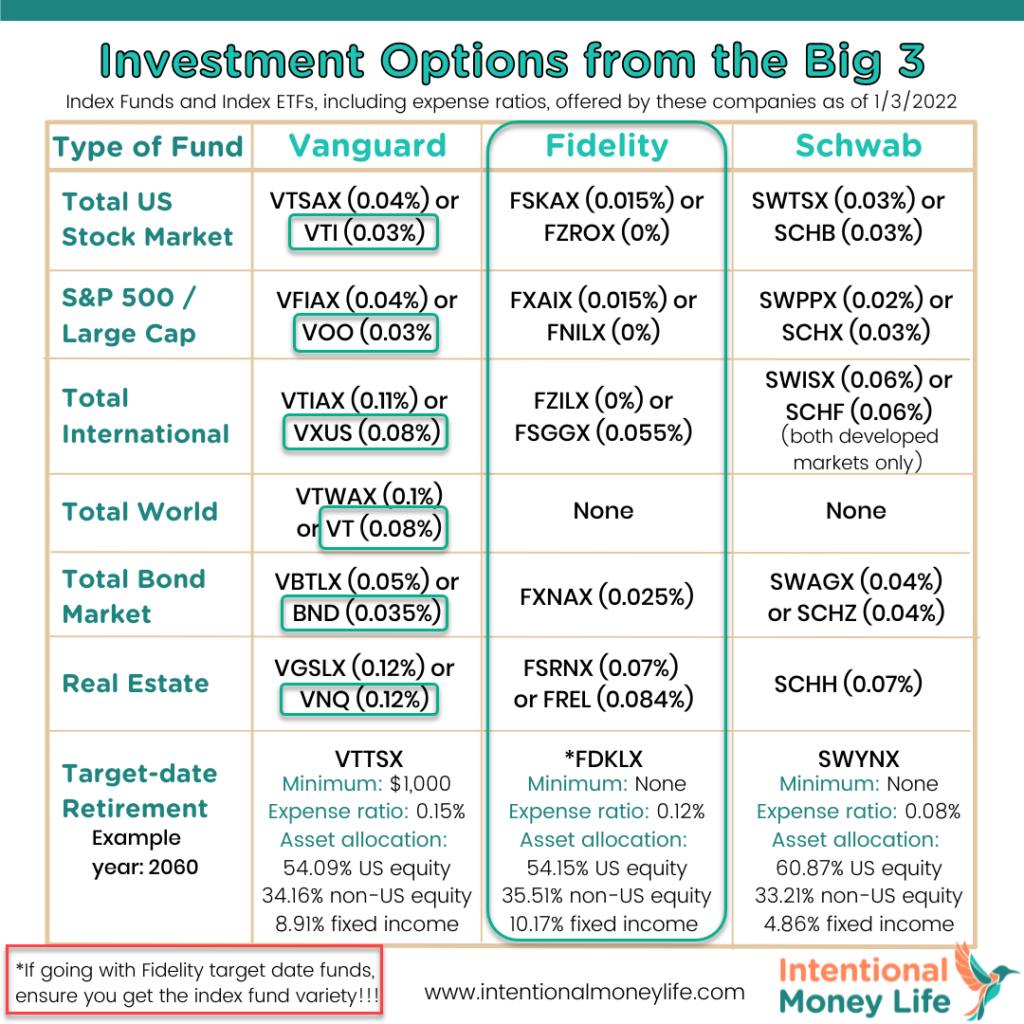

If you have already decided what you plan to invest in, you can skip this section. If you're still wondering, check out the accompanying visual with some of the options. In the Fidelity column, all the options are index funds. They have some zero expense fee index funds that are newer (and perform similarly to the other version, but often invest in less companies and are not portable to another company if you decide to leave Fidelity), as well as the index funds that have been around much longer. Either one is perfectly acceptable. You could also choose the Vanguard ETFs if you're interested in those, which have also been highlighted in the visual.

Two things to note about Fidelity, are that:

1, They offer some ETFs that are not based on the index. They have not been included in the visual, but be aware of that when you’re looking at the Fidelity ETF options.

2, And they have target-date retirement funds that are based on the index and some that aren’t. If you’re wanting a target-date retirement fund, make sure you look for the word “index” and check the expense ratio to ensure you have selected the right version! The index option should be around 0.12% and the non-index versions are more like 0.72%.

Buy your desired index funds or ETFs.

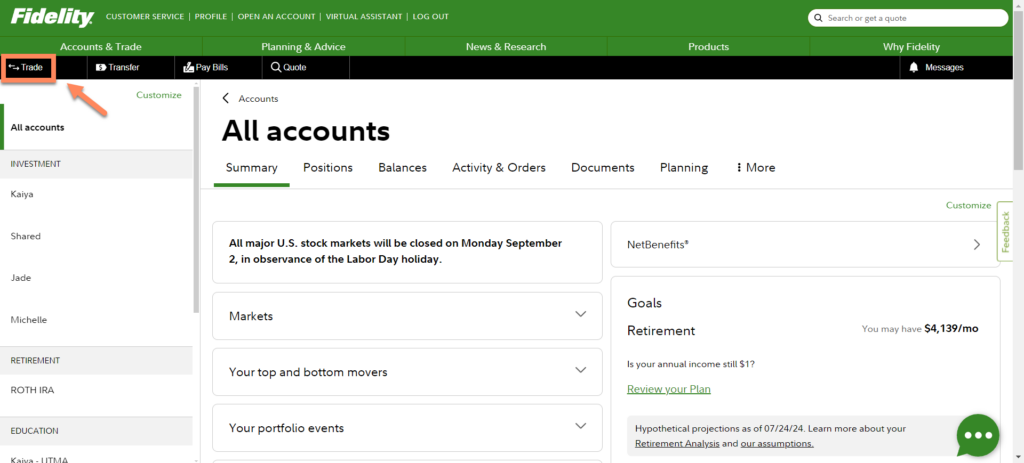

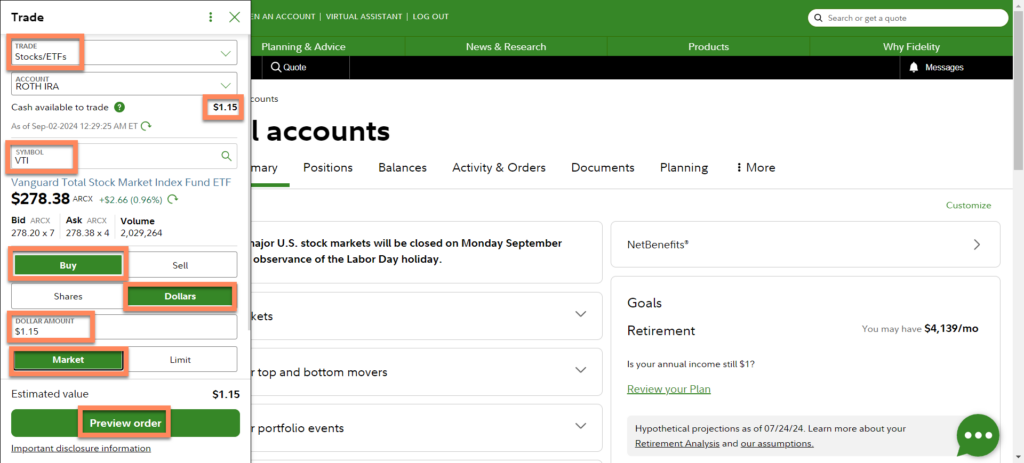

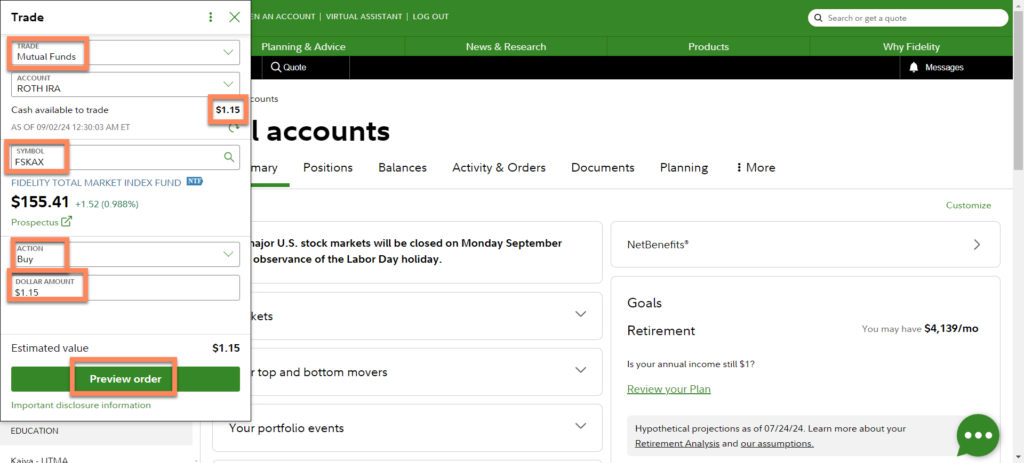

Now you're start from "trade" which was to the left of "transfer", in the black bar along the top. The first thing you'll need to do is decide if you'll be purchasing an index fund (select "mutual fund") or an ETF (select "stocks/EFTs"). Then you'll put in the ticker symbol for whatever it is that you want to purchase (the letters that signify that particular investment, such as FZROX). The questions will be slightly different based on which one you are buying. See the screenshots below for examples of what it looks like to purchase FSKAX, an index fund, and VTI, an ETF. Note that it shows you the cash you have available to buy in that account.

Personally, I prefer to buy in cash amounts, versus buying in whole shares, though that decision is yours to make. I also choose "market orders" when buying ETFs, which means that you'll buy the ETF at whatever the market price is. You could select a limit order, meaning your purchase will only go through if the ETF price is under your limited amount. But for long-term investing, I think it makes a lot more sense to just buy at the price that it is, when you have the money to buy.

Note that your ETF purchase should go through right away, whereas your index fund purchase won't go through until overnight (possibly not for a few nights if the market is currently closed... and it'll go through at the one daily price for that fund).

Automatically reinvest dividends and capital gains.

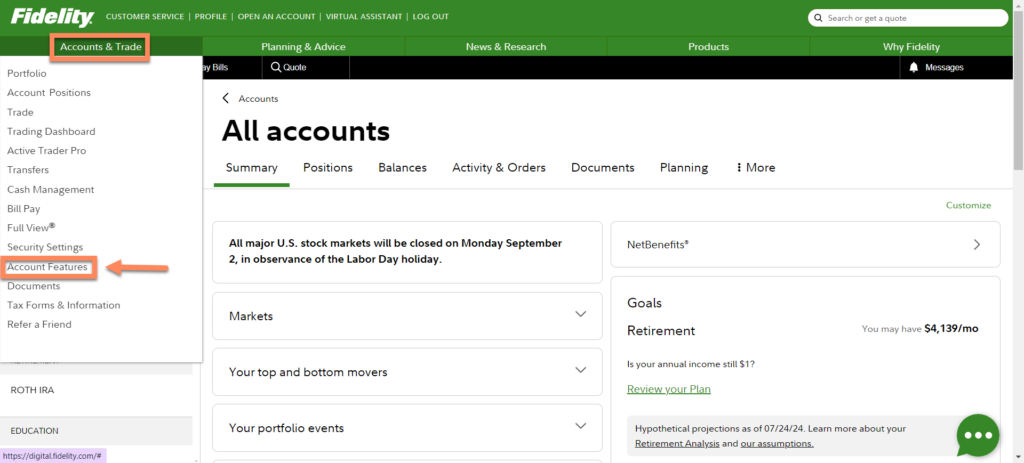

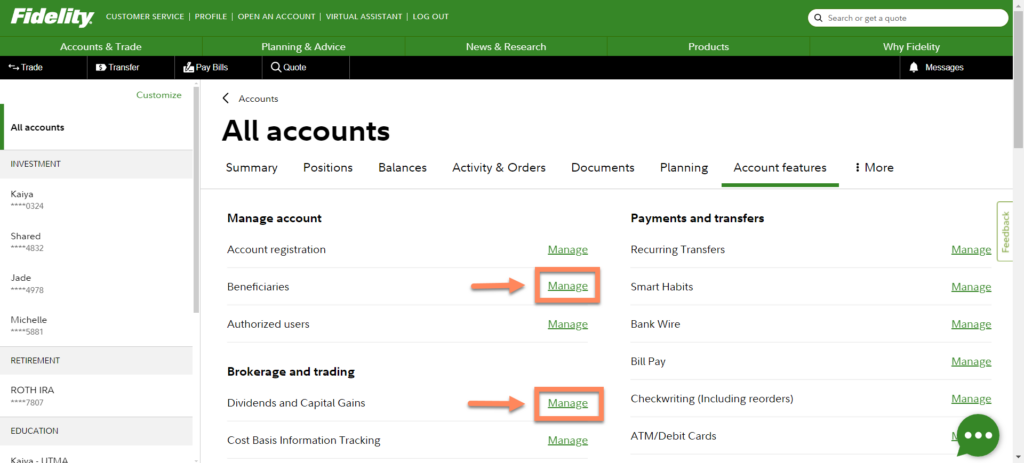

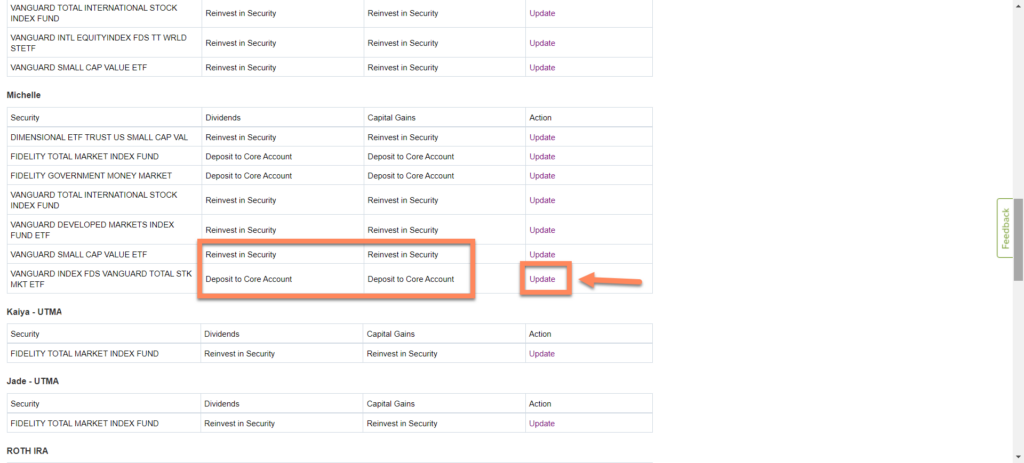

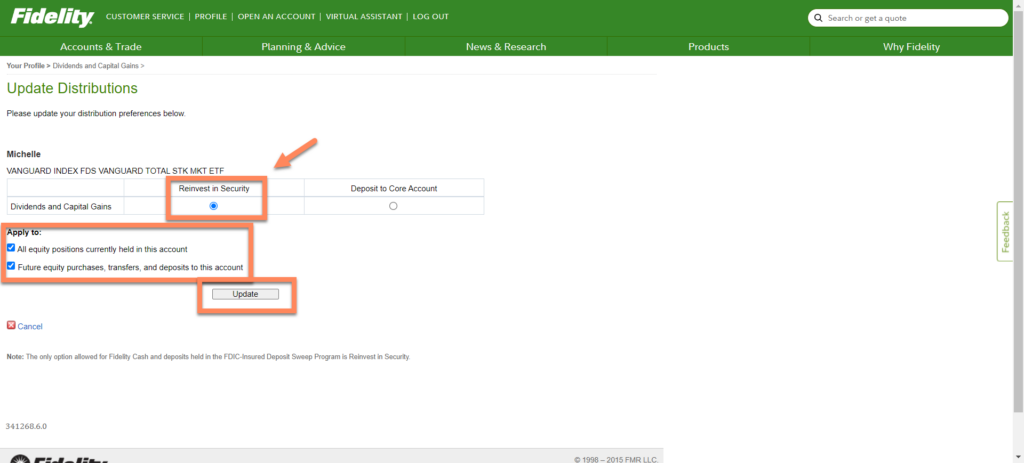

If you purchased index funds, you'll need to wait until your purchase goes through (overnight) before you can set this up. I'm not 100% sure if you need to wait with ETFs, but if your investments don't show up when you try to do this you'll know for sure. Start at the main Fidelity screen and in the top green bar (above trade and transfer) you'll see "Accounts & Trade". Hover over that and the menu will come up. Select "Account Features". Then on the next page, under "Brokerage and trading" you'll see "Dividends and Capital Gains". You'll click the "Manage" next to that. [Also note that from here you can manage beneficiaries!] Then the screen will show all your investments in all of your accounts, and it will have 2 columns, one for Dividends and one for Capital Gains. Check to see what it says for you, and if next to one of your investments it says "Deposit in Core Account" that means the money is NOT being reinvested in the security. Click "update", where you'll be able to select "reinvest in security" and where you'll also be able to tell it apply that to all mutual fund positions in the account" as well as "future" positions in that account. Follow along with the following screenshots.

If you followed the screenshots, you should be all set up, with dividends and capital gains set to reinvest! If you add new funds, it would still be smart to go in here and verify that they are automatically reinvesting, but you should be good!

Automate your investments.

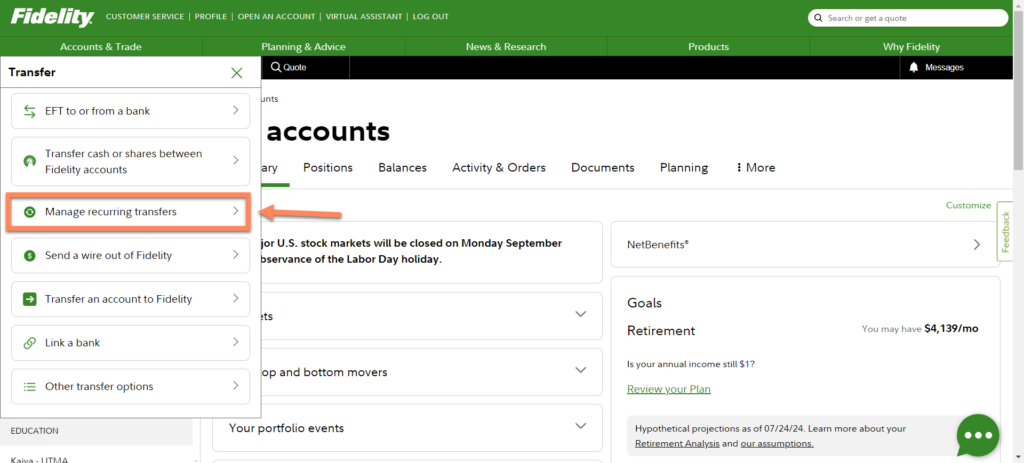

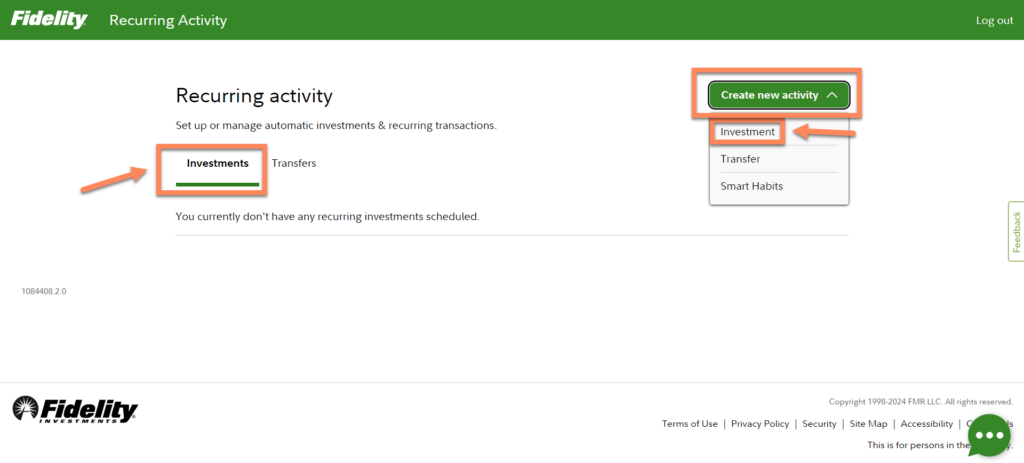

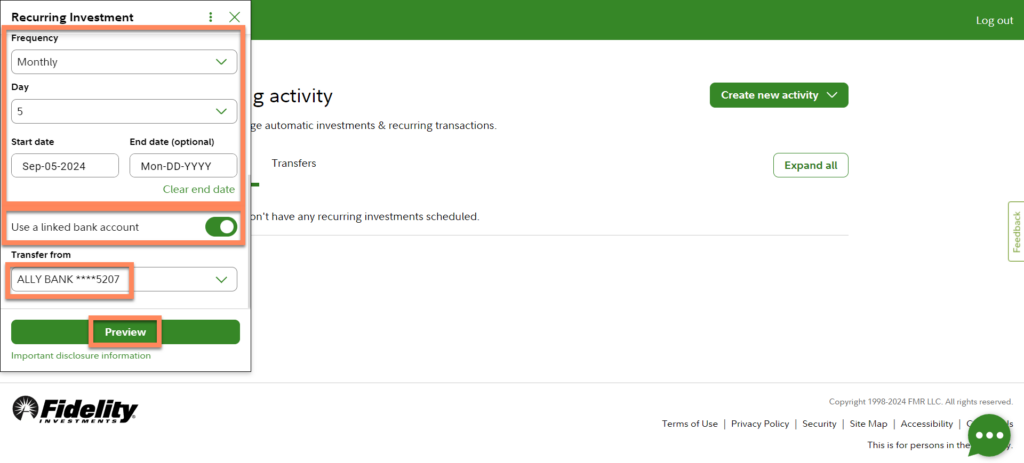

If you can contribute on a regular schedule, I'd highly recommend automating the process! You can do this by setting up an automatic transfer + investment. Go to the main screen and click on "transfer" in the black bar. Then "manage recurring transfers". Then make sure "investments is selected on the left, and then select "create new activity" on the right. That will bring up a drop down, where you'll click on "investments". Then the "buy order" screen comes up, but it says "recurring investment" at the top and as you scroll down you'll get to the information such as the frequency for the investment and where it's coming from. If you select "use a linked bank account" it will load your connected bank accounts to transfer the money from. See screenshots. Once you have this set up, it's also easy to edit it!

You did it!

And you're done! Now you should own at least one index fund or ETF, it should be set up to automatically reinvest dividends and capital gains, and you may even have an automatic investment set up. Congratulations, that was truthfully a huge step towards creating a future that you will love!

We're done, but while we're in here you might as well check on your beneficiaries to make sure they're accurate. Back under "Accounts & Trade" then "Account Features" (where you went to set up the reinvesting), you'll see beneficiaries. Click on there and make sure they're correct.

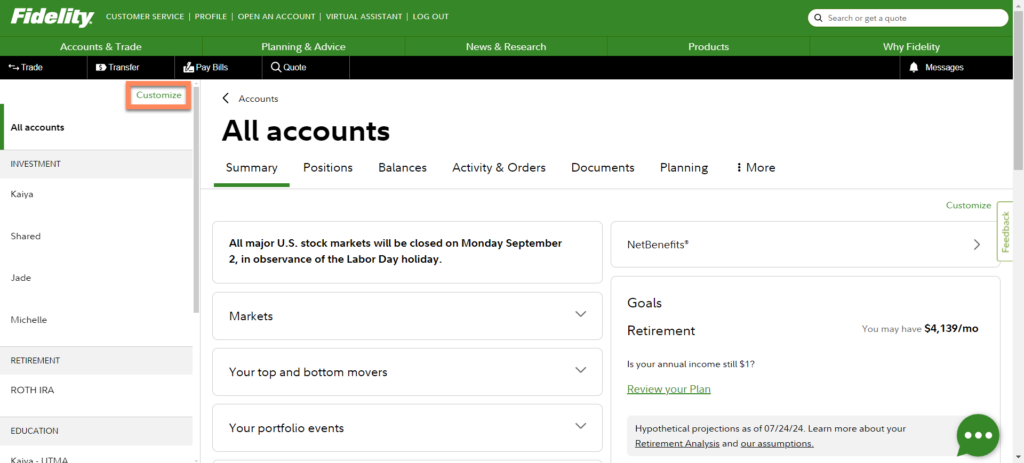

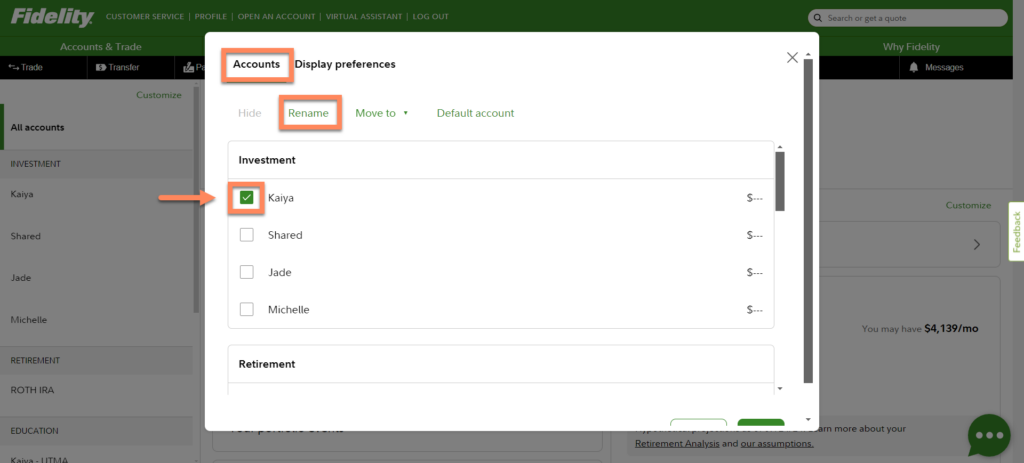

Also, if you'd like to rename your accounts so you remember which one it is, you can do that by clicking on "customize" from the main page. It's just above and to the right of "All accounts" on the lefthand side of your page. If you have it showing "Accounts" then you can select an account, and once you do, "rename" will be clickable. Then you can rename it.

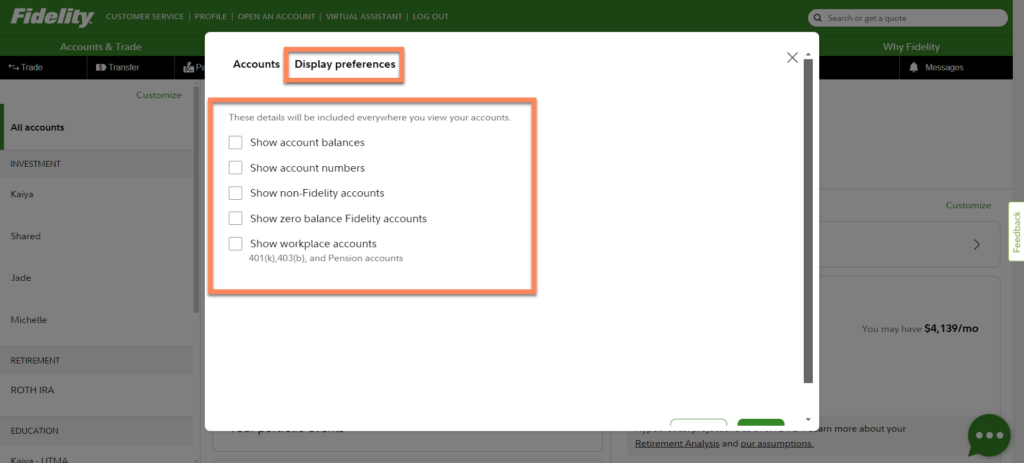

And if you want to update your display settings, such as showing or hiding your account numbers and balances, whether it shows accounts with nothing in them, etc., you can click over to "display preferences" to update that. Note that it will still show the last 4 digits of the account numbers (I have whited them out in this) and it's not perfect (it may still show the full account balance in some places).

If you have any issues with any of the previous steps, Fidelity customer service should be able to walk you through it! Or I could during a 1-hour Nectarine session. You’re also welcome to reach out to me (Instagram is probably best, I’m @intentionalmoneylife).

If you want to learn more about investing (and taxes and retirement and some other things), check out my course, Level Up Your Finances or sign up for a financial planning appointment with me here.

*Note that this blog post is for educational purposes only and is not offering individualized advice.

Would you like to move from financial confusion to financial intention?

My courses and programs are for you if you:

- Feel insecure and overwhelmed about finances.

- Are ready to face your fears and conquer money so you can intentionally save, spend, and invest money in line with your values and goals.

- Want to make strategic decisions, then automate your finances.

- Want to invest to grow your wealth and create time freedom, so you can spend your time how you want, rather than working to survive.

- Would love to provide your children with more opportunities and experiences than were available to you.