Should I Make Roth or Traditional 401k (403b, IRA) Contributions?

So you want to invest for retirement...

but you're not sure if you should choose Roth or traditional contributions.

One of the most impactful things that you can do in order to keep more of your money and not have to pay it in taxes (throughout your lifetime) is to strategically contribute to retirement accounts. [Note that if you want someone to walk you through this decision, you can make an appointment with me here.] Retirement accounts (such as 401ks, 403bs, 457s, IRAs, TSPs, etc.) are special accounts for a few reasons. One, of course, is that it encourages you to set aside and invest money for your future. Another is that your employer may match some of your contributions, automatically giving you a 50% or 100% return on your investment. And another benefit is that this money you set aside in retirement accounts is taxed less than it would be in any other non-retirement account. So at it's heart, this is a tax question. So bear with me, and let's dig into the tax knowledge you need to make this decision...

First, let's understand how taxes work

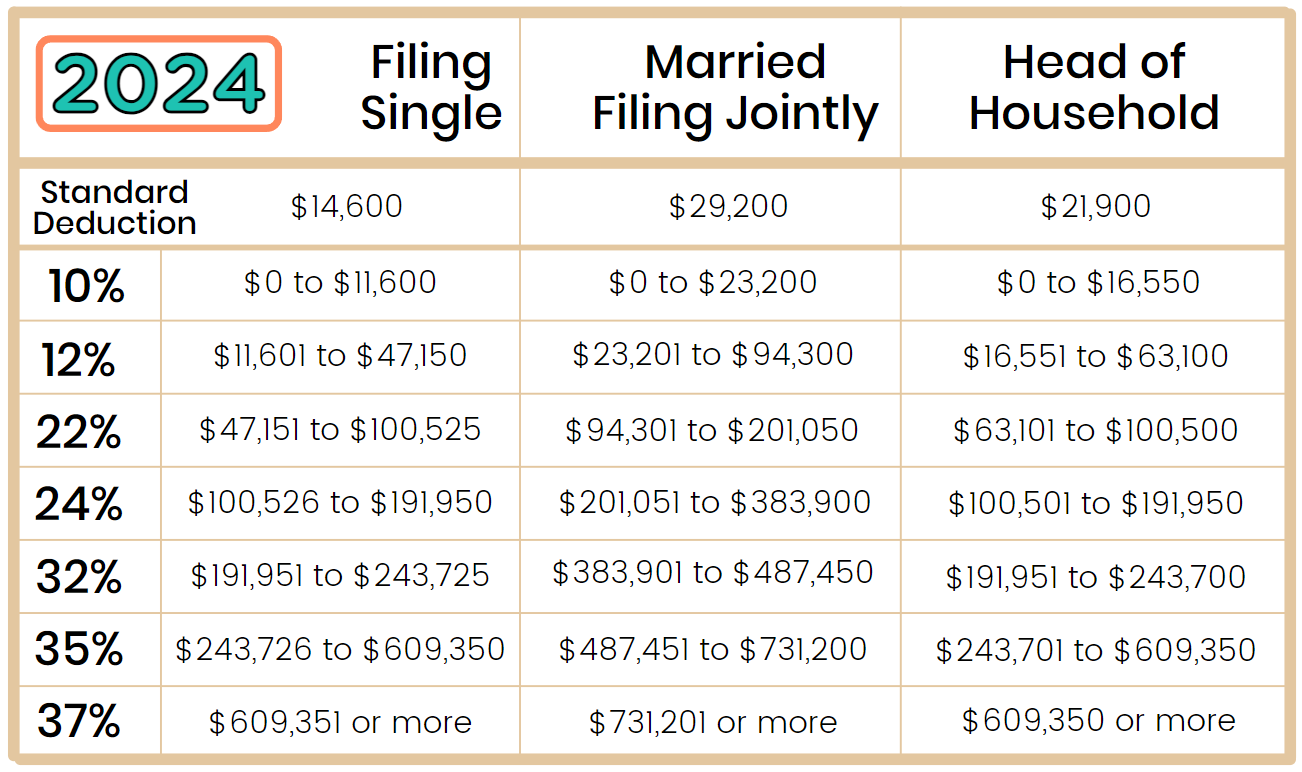

First of all, in the US, our federal income taxes are progressive and marginal. This means that the tax rate progresses as you make more money, however it’s marginal, which means that you don’t pay more in taxes on all the money that you earned, just the amount that put you into a higher tax bracket. For instance, here is the marginal tax bracket chart for 2024. The numbers in the chart refer to your taxable income (after things like the standard deduction), not your total income. If you’re unsure what your taxable income is, pull out your most recent tax return and look for the line titled “taxable income”. This has been line 15 on the 1040 for several years.

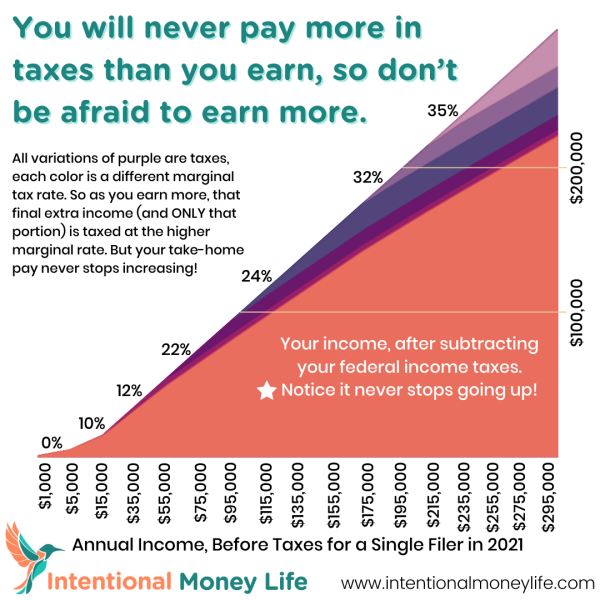

Looking at the chart, you can see that the first $11,600 of taxable income that any single person in the US earns is taxed at the federal tax rate of 10%. Then the income you make from $11,601 – 47,150 is taxed at the rate of 12%. Then the taxable income between $47,151 and $100,525 is taxed at 22%. Moving from one tax bracket to the next never means that all your money will be taxed at a higher rate, just the amount of money over the low threshold of your bracket. This is important and I want to ensure that you understand it. It means that you don’t really have to worry about “moving into a higher bracket” or decide not to do something because you’ll “pay more in taxes”. Yes, you may pay more in taxes on that final $2,000 that you decided to earn, but it won’t make you have to pay more in taxes on the first $47,150 that you earned as well. And notice that the highest tax rate is 37%. So even if you are making $650,000 as a single person, earning an extra $1,000 before taxes will still leave you with over $500 extra. You’ll never lose more to taxes than you earn. And finally, remember that your marginal tax rate is the highest rate you are ever taxed, whereas your effective tax rate is how much you end up paying total in taxes compared to your total income for the year. Because of things like the standard deduction and tax credits, your effective tax rate is often far lower than your marginal one is. For 2022 my federal rate was 12% but my effective rate was 2.57% (your effective rate isn’t usually so drastically lower than your marginal rate, that was primarily due to the child tax credit).

Below, you’ll see a visual that shows how take-home pay continues to increase, even as income increases (it uses tax info from 2021, but nothing has changed besides the specific cutoffs between the brackets).

Taxes and Investing

Okay so now you understand taxes on your regular income. Next, we need to understand a little bit about how taxes work with investment income.

First, to be clear, the investment account is like the cup that holds your investments. What you decide to invest in inside that account is a completely different question. I have a lot of other helpful free resources around investing, you can learn more about getting started with investing, why index funds are such a great option, 10 things you need to know to invest successfully, and stock market and investing basics. Now let's get back to those taxes...

In a regular taxable account, such as a taxable brokerage account (the investing version of just a regular savings account), you would pay taxes on the income before you contribute it to the account, then you’d pay taxes on any dividends, capital gains, or interest you earned throughout each year, then you’d pay taxes on capital gains when you eventually sell the asset. These tax rates are often actually lower than your normal income tax rates, and they are still marginal, but it's still something you pay taxes on.

However, in a retirement account, you automatically don’t have to pay taxes on dividends, interest, or capital gains each year. So money inside your retirement accounts doesn’t have any tax consequences each year. On top of that, there are two options for how you can contribute to the retirement account (though not all companies offer both options, and not everyone is eligible for each option).

One, you can choose to put the money into a traditional or tax-deferred retirement account before it gets taxed, which reduces your taxable income in the present. Then, when you take the money out in retirement, when theoretically you have less income coming in and therefore pay less in taxes anyway, you’ll pay taxes on the full amount that you take out each year.

Or two, you can choose to put the money into the Roth account (after you paid income taxes on it based on your current tax rate), and then never pay taxes on it (or its growth) again.

More on Taxes and Retirement Accounts

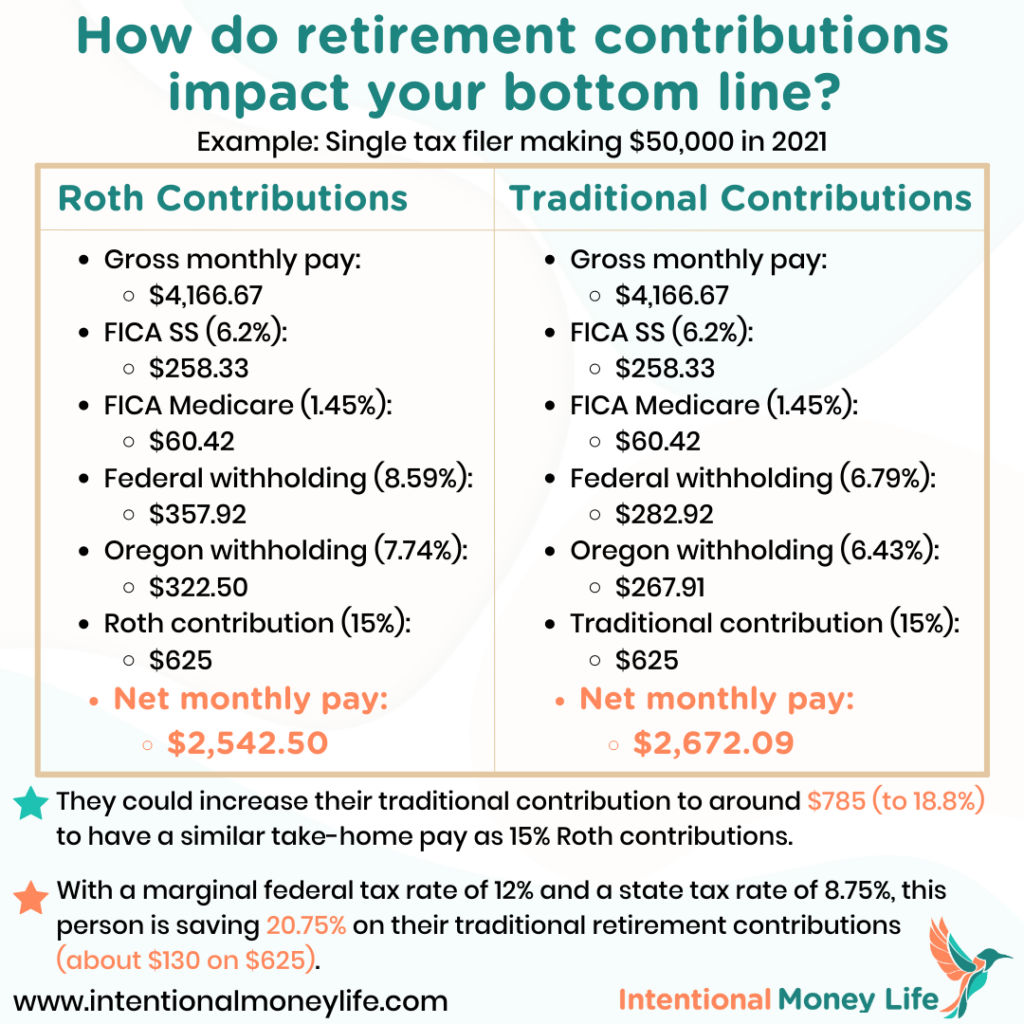

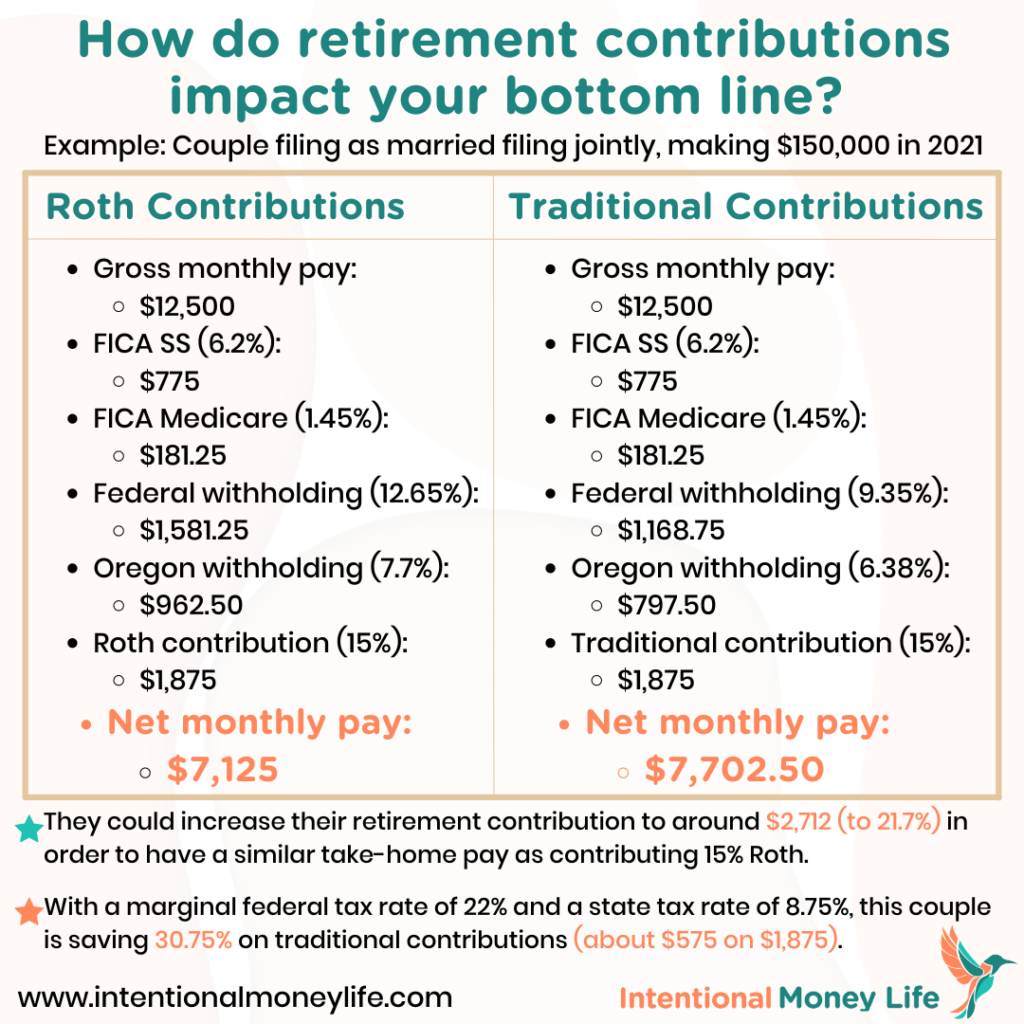

One thing to understand is that if you contribute to a traditional retirement account, you will save money at the rate of your current federal + state marginal tax rates. This is because you can see your retirement contributions as the final dollars you earn, which are taxed at your highest rate as discussed earlier.

So, for instance, if you were at the 22% federal + 8.75% state rates, then your marginal tax rate (for the final money you earn) would be 30.75%. So if you contributed $10,000 to your traditional retirement account, then your overall pay would only go down by $6,925, since you would save $3,075 in taxes. Which also means you can contribute more today if you do it inside of traditional accounts, since you won’t be reducing your paycheck by that full contribution amount (once again, that’s because you’re reducing your taxes owed).

And if you contribute to a Roth account, you won’t save money this year on those contributions, if you put $500 into the account that will reduce your paycheck by the full $500, but you’ll save money in retirement since all the money you take out of Roth accounts is tax-free (assuming you followed the rules and are old enough to access the full funds at that time). So the benefit here is during retirement. When you have a variety of different accounts, you can choose how much to take out of each to keep your taxes lower. And always, taking out that Roth money will not increase those taxes!! So if you get surprised by a $50,000 bill to fix your cracked house foundation or replace your roof, you could take out that full $50,000 without increasing your taxable income at all!

Check out the infographics below that help show examples of what your tax and take home pay situations could look like making Roth versus traditional retirement contributions. [Note that your FICA taxes are not reduced by either of these contributions, however you could reduce those FICA taxes by contributing to an FSA or HSA if you have access to either.]

So how do I use this tax information to make a decision?

This tax knowledge is some of the basic info you need to understand so you can make the traditional versus Roth decision. It can still be quite complicated and very dependent on your own situation though. Some things you'll want to consider are: how old will I be at retirement, what kinds of income will I have in retirement, how does my current tax status compare to my expected future tax status, and when will my taxes be the lowest (choose Roth contributions then!). I will list some reasons to choose each option below, but in the end you may benefit from consulting a tax professional and/or a financial planner (you can book a meeting with me here) and asking for both their recommendation and their reasoning for that recommendation. At a minimum, anyone helping you to decide this should consider your current taxable income, your future expected taxable income, your retirement age and date, your expected income in retirement and sources of that income, your current financial situation, your goals and retirement plans, and any money you currently have invested in retirement accounts (and in which kinds of accounts) or in taxable brokerage accounts. Knowing all of that...

Reasons to make traditional contributions

-

You are currently making a lot of money, and therefore your money is being taxed at a higher (marginal) rate now than you expect (your effective tax rate to be) in the future. It can help you reduce your tax burden now.

-

You are in the marginal tax bracket of 22% or higher.

-

You work for a company that only offers tax-deferred retirement account options, or that only matches if you contribute tax-deferred.

-

You are close to retirement, especially if you are also earning a high salary.

-

You already have a lot of money in Roth accounts, so putting some money in traditional accounts will help you reduce your current tax burden, and in the future you can strategically pull from the two kinds of accounts to keep your tax burden low in retirement.

-

You think your taxable income in retirement will be lower than it is now.

-

Money is really tight and it’s the only way you can imagine contributing to retirement at all.

-

You live in a state with income taxes now and expect to retire to one without income taxes.

-

You are close to being eligible for a tax credit or deduction or some other tax-related benefit and contributing this way might make you eligible for it.

-

You expect to have some years with little income (or at least lower income), when you could convert some of your traditional contributions to Roth contributions (when you do this, you pay taxes on the amount converted at your current tax rate, hence the need for a lower income year). This can be a great strategy if you'll definitely have years of lower income! To use this strategy to access retirement funds early, you'll want to learn about the Roth Conversion ladder.

Reasons to choose Roth contributions

-

You are fairly young and therefore have a long time for your money to grow and compound tax-free. This also usually means you’re in a lower tax bracket now than you will be later.

-

You are in the 12% federal tax bracket or lower, as your tax burden is fairly low already and may not go lower in retirement. [Or you're a child who doesn't earn enough money to pay any taxes!]

-

You expect to have taxable income, such as a pension, passive income, traditional retirement contributions, or matched retirement contributions (which always still need to be taxed), and therefore could use some Roth money to pull from in retirement in order to be strategic and keep your taxable income in retirement lower.

-

You think taxes in general will go up over time and/or you expect your future income tax bracket to be taxed at a higher rate than it is now. Or you currently live in a state with no income tax and expect to move to a state with income taxes in retirement.

-

You expect your taxable income in retirement to be higher than it is now, meaning you expect your effective tax rate to be higher than your current marginal tax rate.

-

You want to have more money in Roth accounts so that you can pass it on to family members, and you don’t mind paying the taxes on it now and at your current tax rates.

-

You already have a lot of money in traditional accounts and you don’t have much in Roth accounts, and you don’t expect to have lower income years (such as the years between when you stop working and when you start taking Social Security, or before you start taking RMDs) and therefore want to just pay your taxes now and get the money into Roth accounts.

-

You worry that the government may take away your ability to contribute to a Roth IRA in the future and want to get money in it now.

-

You’re already taking full advantage of your work-related traditional retirement account but want to put more money away for retirement, yet you’re over the limit to deduct traditional IRA contributions anyway (if you're also over the income limit to contribute directly to the Roth IRA you may be able to do backdoor Roth IRA contributions).

Check out (and save) the infographic below for the most simplified version of the Roth versus traditional question.

An example (how we do it)

Overall, we try to stay in or close to the 12% tax bracket, which also reduces the taxes we pay on the money we have invested in taxable brokerage account.

Up until now, we've been in the 12% tax bracket. So (nearly) everything we have contributed has been to Roth accounts. We each max our Roth IRAs annually, and since I had access to a 403b and 457 when I worked in higher education, I made Roth contributions there as well. When I left higher education in June of 2023, we could no longer contribute to anything besides our IRAs (my partner does not have any retirement options at his work). Then in September my kids and I got new health insurance that makes us eligible for an HSA. So I am maxing that account as well, since I will never have to pay taxes on that money (nor on the growth).

As of February of 2024, I am just now getting access to my new employer's 401k. They are offering me a 100% match up to 6%, so I will be contributing 6% for sure (don't miss out on money!). I have chosen to start with traditional contributions, because there's a chance that our income will move us up to the 22% tax bracket this year. I personally would/will switch my work-related contributions to traditional and hold on to the Roth IRA as long as I can (partly, this is necessary because your ability to get a deduction on traditional IRA contributions is connected to your income anyway). I'll reconsider this in a few months and if I think we'll still be at 12% or lower I'll probably switch the contributions to Roth. We will continue to max our Roth IRAs and our HSA as well.

So what will you do?

I’d love to hear from you about this. What kinds of contributions have you decided to make? Have you figured out when you might change that strategy? Go find me on Instagram or Facebook and let me know! And if you want to learn more about investing and taxes and retirement planning, check out Level Up Your Finances! Or if you want free resources, there’s my Investing 101 downloadable pdf. Or you can check out my Level Up Preview, which allows you to complete a portion of Level Up Your Finances for FREE!

Disclaimer: This is not tax or investment advice, but for educational purposes only. If you would like investment advice, or someone to help you make this decision, you can make an appointment with me here.

Would you like to move from financial confusion to financial intention?

My courses are for you if you:

- Feel insecure and overwhelmed about finances.

- Are ready to face your fears and conquer money so you can intentionally save, spend, and invest money in line with your values and goals.

- Want to make strategic decisions, then automate your finances.

- Want to invest to grow your wealth and create time freedom, so you can spend your time how you want, rather than working to survive.

- Would love to provide your children with more opportunities and experiences than were available to you.